Blank Business Purchase and Sale Agreement Form

When entering into a transaction involving the sale or purchase of a business, a Business Purchase and Sale Agreement serves as a critical document that outlines the terms and conditions of the deal. This agreement typically encompasses several key elements, including the identification of the parties involved, a detailed description of the business being sold, and the purchase price. It also addresses the payment structure, which may involve lump-sum payments or installments, and outlines any contingencies that must be met before the sale can be finalized. Additionally, the agreement often includes representations and warranties, ensuring that both parties are transparent about the business's financial health and operational status. Furthermore, it may stipulate any conditions for the transfer of assets, liabilities, and employees, as well as post-sale obligations to protect both the buyer's and seller's interests. By clearly delineating these aspects, the Business Purchase and Sale Agreement helps to mitigate risks and foster a smoother transition during the ownership change, ultimately contributing to the success of the new business arrangement.

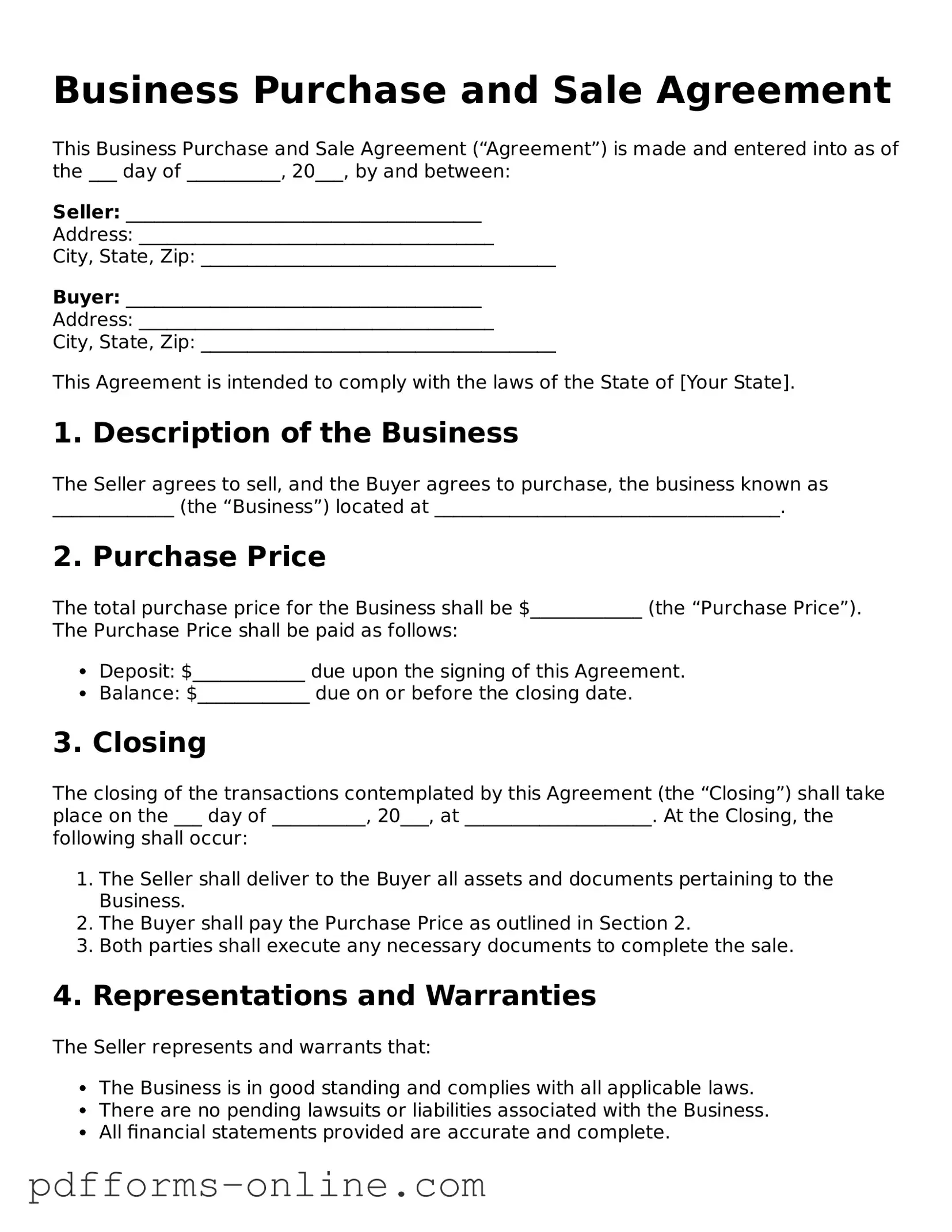

Document Example

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement (“Agreement”) is made and entered into as of the ___ day of __________, 20___, by and between:

Seller: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

Buyer: ______________________________________

Address: ______________________________________

City, State, Zip: ______________________________________

This Agreement is intended to comply with the laws of the State of [Your State].

1. Description of the Business

The Seller agrees to sell, and the Buyer agrees to purchase, the business known as _____________ (the “Business”) located at _____________________________________.

2. Purchase Price

The total purchase price for the Business shall be $____________ (the “Purchase Price”). The Purchase Price shall be paid as follows:

- Deposit: $____________ due upon the signing of this Agreement.

- Balance: $____________ due on or before the closing date.

3. Closing

The closing of the transactions contemplated by this Agreement (the “Closing”) shall take place on the ___ day of __________, 20___, at ____________________. At the Closing, the following shall occur:

- The Seller shall deliver to the Buyer all assets and documents pertaining to the Business.

- The Buyer shall pay the Purchase Price as outlined in Section 2.

- Both parties shall execute any necessary documents to complete the sale.

4. Representations and Warranties

The Seller represents and warrants that:

- The Business is in good standing and complies with all applicable laws.

- There are no pending lawsuits or liabilities associated with the Business.

- All financial statements provided are accurate and complete.

5. Conditions Precedent

The obligations of the Buyer to complete the purchase are subject to the following conditions:

- Completion of due diligence to Buyer's satisfaction.

- Approval of financing determined necessary by the Buyer.

- Delivery of clear title to the assets being purchased.

6. Governing Law

This Agreement shall be governed by, and construed in accordance with, the laws of the State of [Your State].

7. Miscellaneous

This Agreement constitutes the entire agreement between the parties. It may only be amended in writing signed by both parties. Any notices must be sent to the addresses stated above.

IN WITNESS WHEREOF, the parties have executed this Business Purchase and Sale Agreement as of the date first above written.

_____________________________

Seller Signature

_____________________________

Buyer Signature

Frequently Asked Questions

-

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. It details the rights and responsibilities of both the buyer and the seller. This agreement typically includes information about the purchase price, payment terms, and any warranties or representations made by either party.

-

What key elements should be included in the agreement?

Essential elements of a Business Purchase and Sale Agreement include:

- The names and contact information of the buyer and seller.

- A detailed description of the business being sold, including assets and liabilities.

- The purchase price and payment terms, such as deposits and financing arrangements.

- Any conditions that must be met before the sale can be completed.

- Warranties or representations made by either party.

- Confidentiality clauses and non-compete agreements, if applicable.

-

Why is it important to have this agreement in writing?

Having a Business Purchase and Sale Agreement in writing helps protect both the buyer and the seller. It provides a clear record of what was agreed upon, reducing the chances of misunderstandings or disputes later on. Written agreements are also easier to enforce in court if necessary.

-

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and the seller to ensure clarity and enforceability.

-

What happens if one party breaches the agreement?

If one party breaches the Business Purchase and Sale Agreement, the other party may have legal recourse. This could include seeking damages or specific performance, which means asking the court to enforce the terms of the agreement. The specific remedies available will depend on the terms outlined in the agreement and applicable state laws.

Misconceptions

Understanding the Business Purchase and Sale Agreement (BPSA) is crucial for anyone involved in buying or selling a business. However, several misconceptions can lead to confusion. Here are seven common misconceptions about the BPSA:

- It is only necessary for large transactions. Many believe that a BPSA is only relevant for significant business deals. In reality, even small transactions benefit from a formal agreement to outline terms and protect both parties.

- It is a one-size-fits-all document. Some think that a standard template can be used for all transactions. Each business deal is unique, and the BPSA should be tailored to fit the specific circumstances and needs of the parties involved.

- Verbal agreements are sufficient. Many assume that a verbal agreement is enough to finalize a sale. However, a written BPSA provides clarity and legal protection, reducing the risk of misunderstandings.

- Only the buyer needs to review the agreement. Some individuals believe that only the buyer should focus on the details of the BPSA. In truth, both parties must carefully review the agreement to ensure that their interests are adequately protected.

- Once signed, the agreement cannot be changed. There is a misconception that a signed BPSA is set in stone. In fact, amendments can be made if both parties agree to the changes, allowing for flexibility as circumstances evolve.

- The BPSA covers all aspects of the transaction. Many think that the BPSA addresses every detail of the sale. While it covers essential terms, additional documents may be necessary to address specific issues, such as financing or lease agreements.

- Legal assistance is not needed. Some believe they can handle the BPSA without professional help. However, consulting with legal and financial experts can provide valuable insights and ensure that the agreement meets all legal requirements.

Addressing these misconceptions can lead to a smoother transaction process and better outcomes for both buyers and sellers.

Common mistakes

-

Not Clearly Identifying the Parties: One common mistake is failing to clearly identify all parties involved in the transaction. This includes ensuring that names are spelled correctly and that the legal status of each party (individual, corporation, etc.) is accurately noted.

-

Omitting Key Terms: Important terms such as purchase price, payment structure, and timelines can be overlooked. These details are crucial for avoiding misunderstandings later on.

-

Ignoring Contingencies: Not including contingencies can lead to problems. Contingencies protect both parties and should cover items like financing or inspections.

-

Neglecting to Specify Assets: Failing to clearly list which assets are included in the sale can cause disputes. It’s important to detail everything from inventory to equipment.

-

Overlooking Liabilities: Buyers should be aware of any liabilities associated with the business. Not addressing these can lead to unexpected financial burdens.

-

Inadequate Due Diligence: Skipping thorough due diligence can be a costly mistake. Buyers should investigate the business's financials, legal status, and operational issues before signing.

-

Failing to Include a Non-Compete Clause: Without a non-compete clause, sellers might start a competing business right after the sale, which can harm the buyer’s investment.

-

Not Consulting Professionals: Some individuals attempt to fill out the agreement without legal or financial advice. This can lead to mistakes that could have been avoided with expert guidance.

-

Missing Signatures: It might seem basic, but forgetting to have all necessary parties sign the agreement can render it invalid. Double-checking signatures is essential.

-

Not Understanding the Terms: Finally, many people sign agreements without fully understanding the terms. Taking the time to read and comprehend the document can prevent future issues.

Popular Templates

Lyft Inspection Form 2023 - Inspect the air filter for cleanliness and blockage.

An Investment Letter of Intent (LOI) is a document that outlines the preliminary agreement between an investor and a party looking to sell assets, partake in a business venture, or engage in other financial transactions. It acts as a blueprint, detailing the basic terms and conditions under which the investment will be made, before finalizing a formal agreement. This essential form helps both parties understand their obligations and the scope of the potential investment, setting a framework for further negotiations. For more information on this topic, visit https://onlinelawdocs.com/.

Yugioh Deck List Form - This area is for judge use to finalize the check process.

Blank 1099 Nec Form 2023 - The IRS provides specific instructions for completing and filing the 1099-NEC.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which a business is bought or sold. |

| Parties Involved | The agreement typically involves a seller, who is transferring ownership, and a buyer, who is acquiring the business. |

| Governing Law | The agreement is governed by the laws of the state where the business operates. For example, in California, the relevant laws are found in the California Commercial Code. |

| Key Components | Essential elements include purchase price, payment terms, and a description of the assets being sold. |

| Confidentiality Clause | Many agreements include a confidentiality clause to protect sensitive information shared during negotiations. |

| Due Diligence | Buyers often conduct due diligence to verify the seller’s claims about the business's financial health and operational status. |

| Warranties and Representations | The seller may provide warranties about the business, assuring the buyer of certain conditions or facts. |

| Contingencies | Agreements may include contingencies that must be met before the sale can be finalized, such as obtaining financing. |

| Closing Process | The closing process involves finalizing the sale, transferring ownership, and ensuring all legal requirements are met. |

Similar forms

The Business Purchase and Sale Agreement is similar to a Real Estate Purchase Agreement. Both documents outline the terms and conditions under which a buyer will acquire an asset. In the case of real estate, the asset is property, while in a business sale, the asset may include equipment, inventory, or goodwill. Each agreement specifies the purchase price, payment terms, and any contingencies that must be met before the sale can be finalized. Just as a Real Estate Purchase Agreement protects the interests of both the buyer and seller, the Business Purchase and Sale Agreement serves the same purpose in a business transaction.

Another document that shares similarities is the Asset Purchase Agreement. This type of agreement is specifically focused on the purchase of individual assets rather than the entire business entity. Like the Business Purchase and Sale Agreement, it details the assets being sold, the purchase price, and the responsibilities of both parties. Both agreements often include clauses about warranties, liabilities, and the transfer of ownership, ensuring a clear understanding of what is being bought and sold.

The Stock Purchase Agreement also resembles the Business Purchase and Sale Agreement. This document is used when a buyer is purchasing shares of a corporation, thereby acquiring ownership in the company itself. Similar to the Business Purchase and Sale Agreement, it outlines the purchase price, the number of shares being sold, and any conditions that must be satisfied prior to the sale. Both agreements aim to protect the interests of the parties involved and provide clarity on the transaction's terms.

A Letter of Intent (LOI) is another document that shares characteristics with the Business Purchase and Sale Agreement. An LOI is often used at the beginning of negotiations to outline the basic terms and intentions of the parties before a formal agreement is drafted. While it is not as detailed as a Business Purchase and Sale Agreement, it serves as a roadmap for the transaction, highlighting key points such as the proposed purchase price and timeline. Both documents play a crucial role in facilitating business transactions and ensuring that all parties are on the same page.

When considering joining a sorority, it's essential to understand the importance of a Sorority Recommendation Letter, which acts as a vital endorsement from an alumna highlighting the candidate's qualifications and character. For more information and templates to assist in crafting this critical document, visit TopTemplates.info.

Finally, a Confidentiality Agreement, or Non-Disclosure Agreement (NDA), is also related to the Business Purchase and Sale Agreement. While the latter focuses on the sale itself, the NDA is concerned with protecting sensitive information exchanged during the negotiation process. Both documents are essential in business transactions; the Business Purchase and Sale Agreement formalizes the sale, while the NDA ensures that proprietary information remains confidential. Together, they create a secure environment for conducting business negotiations.