Blank Business Credit Application Template

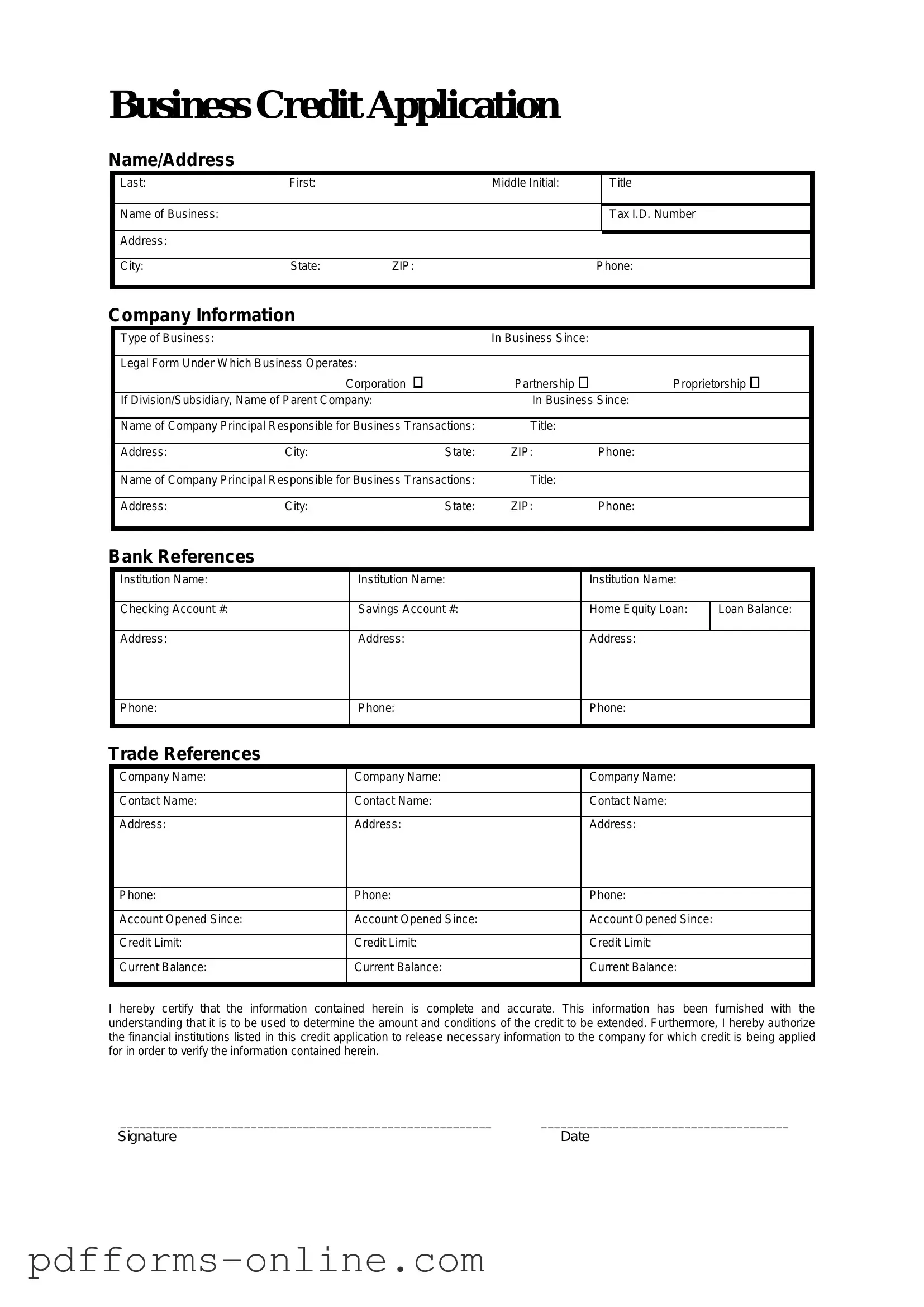

The Business Credit Application form serves as a critical tool for businesses seeking to establish credit with suppliers or lenders. This form typically includes essential information such as the business's legal name, address, and type of entity, which helps creditors verify the identity and legitimacy of the applicant. Additionally, it often requires details about the business’s financial history, including annual revenue and existing debts, providing insight into its creditworthiness. Contact information for key personnel, such as owners or financial officers, is usually requested to facilitate communication. Furthermore, the form may ask for trade references, which can support the application by demonstrating a history of responsible credit use. Understanding these components is vital for businesses aiming to navigate the credit application process effectively and secure the necessary funding for growth and operations.

Document Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Frequently Asked Questions

-

What is a Business Credit Application form?

The Business Credit Application form is a document that businesses complete to apply for credit with a lender or supplier. This form provides essential information about the business, including its financial history, ownership structure, and credit needs.

-

Why do I need to fill out this form?

Completing the Business Credit Application is necessary for obtaining credit. Lenders use the information to assess the risk of lending to your business. A well-filled application can enhance your chances of securing favorable credit terms.

-

What information is typically required on the form?

The application usually asks for:

- Business name and address

- Type of business entity (e.g., LLC, corporation)

- Owner's personal information

- Tax identification number

- Financial statements and credit references

-

How long does it take to process the application?

Processing times can vary. Typically, it may take anywhere from a few days to a couple of weeks. Factors such as the lender's workload and the completeness of your application can affect the timeline.

-

What happens if my application is denied?

If your application is denied, the lender is required to provide a reason. Common reasons include insufficient credit history, low credit scores, or inadequate financial information. You can use this feedback to improve your application for the future.

-

Can I apply for credit if my business is new?

Yes, new businesses can apply for credit. However, lenders may require additional documentation, such as a business plan or personal guarantees from the owners. Establishing a strong credit profile early on is crucial.

-

Is there a fee to submit the application?

Most lenders do not charge a fee to submit a Business Credit Application. However, some may have associated costs for processing or credit checks. It’s best to clarify this with the lender before applying.

-

What should I do if I have questions while filling out the form?

If you have questions, reach out to the lender or supplier for assistance. They can provide guidance on specific sections of the form and clarify any requirements. It’s important to ensure that all information is accurate and complete.

Misconceptions

When it comes to filling out a Business Credit Application form, many misconceptions can lead to confusion. Here are ten common misunderstandings that you might encounter:

- Only large businesses need to apply for credit. Many small businesses also require credit to manage cash flow or invest in growth opportunities.

- All credit applications are the same. Each lender may have different requirements and forms, so it’s essential to read the specific application carefully.

- Providing personal information is unnecessary. Lenders often require personal guarantees, especially from small business owners, to assess risk.

- A good credit score guarantees approval. While a good credit score is beneficial, lenders also consider other factors like business history and revenue.

- Once submitted, the application cannot be changed. If you notice an error after submission, you can often contact the lender to correct it.

- Credit applications are only for loans. They can also be used for lines of credit, vendor accounts, and leasing agreements.

- It's okay to leave sections blank. Incomplete applications may be rejected or delayed, so it’s best to fill out every section as thoroughly as possible.

- There’s no need to prepare financial documents. Many lenders will ask for financial statements, tax returns, or profit and loss statements to assess your business's financial health.

- The application process is quick and easy. While some applications may be straightforward, others can take time and require careful consideration.

- Approval means you can access all requested credit immediately. Sometimes, lenders may approve a lower amount than requested or set specific terms for the credit.

Understanding these misconceptions can help you navigate the Business Credit Application process more effectively. Always read the instructions carefully and provide accurate information to increase your chances of approval.

Common mistakes

-

Incomplete Information: Failing to provide all required details can delay the application process. Ensure that every section is filled out thoroughly.

-

Incorrect Business Structure: Misidentifying the type of business entity can lead to issues. Make sure to select the correct structure, whether it’s a sole proprietorship, partnership, or corporation.

-

Missing Financial Statements: Not including recent financial statements may raise red flags. Attach your balance sheet and income statement for better credibility.

-

Inaccurate Contact Information: Providing wrong phone numbers or email addresses can hinder communication. Double-check all contact details before submission.

-

Overlooking Personal Guarantees: Many lenders require personal guarantees. Failing to understand this requirement can lead to denial.

-

Ignoring Credit History: Not being aware of your business credit score can be detrimental. Review your credit report beforehand to address any discrepancies.

-

Neglecting to Specify Credit Amount: Not indicating the desired credit limit can result in confusion. Clearly state how much credit you are requesting.

-

Providing Outdated Information: Using old data can misrepresent your business’s current status. Always use the most recent information available.

-

Failing to Read the Terms: Skipping over the fine print can lead to misunderstandings. Carefully read all terms and conditions before signing.

Additional PDF Templates

Acord Application - This form facilitates the collection of essential information related to workers' compensation policies.

Employment Application in Spanish - Willingness to work overtime is an important consideration for many employers.

Document Data

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | Typically, the form requests details such as business name, address, tax identification number, and financial information. |

| Personal Guarantee | Many applications may require a personal guarantee from the business owner, ensuring accountability for repayment. |

| Credit Terms | The form often outlines the credit terms offered, including payment schedules and interest rates. |

| State-Specific Forms | Some states may have specific requirements or variations in the form based on local laws. |

| Governing Laws | For example, in California, the form is governed by the California Commercial Code. |

| Confidentiality | Information provided in the application is usually kept confidential and used solely for credit assessment. |

| Approval Process | The approval process may vary, often including a review of the business's credit history and financial stability. |

Similar forms

The Business Loan Application form serves a similar purpose to the Business Credit Application form. Both documents are used by businesses seeking financial assistance. The loan application requires detailed information about the business, including its financial history, ownership structure, and purpose for the loan. Just like the credit application, this form helps lenders assess the risk and make informed decisions about extending credit or loans to the business.

The Vendor Credit Application is another document that closely resembles the Business Credit Application. This form is typically used when a business wants to establish a line of credit with a vendor or supplier. It collects information about the business's creditworthiness, including payment history and references. Both applications aim to evaluate the financial reliability of the business before extending credit terms.

The Personal Guarantee form is similar in that it may accompany a Business Credit Application. This document requires the business owner to pledge personal assets as security for the business’s credit. While the Business Credit Application focuses on the business's financials, the Personal Guarantee adds a layer of personal accountability, which lenders may require for higher-risk applicants.

The Business Financial Statement is another related document. This statement provides a snapshot of the business's financial health, including income, expenses, assets, and liabilities. Lenders often request this document alongside the Business Credit Application to gain a clearer understanding of the business's financial standing and ability to repay any credit extended.

The Trade Reference form is also similar, as it provides information about the business's past credit relationships. This document lists suppliers or vendors that have extended credit to the business and details the payment history with each. It helps lenders verify the business’s creditworthiness, much like the information gathered in the Business Credit Application.

The Corporate Resolution document may also be relevant. This document outlines the authority of individuals within a business to apply for credit. It confirms that the person signing the Business Credit Application has the legal right to do so. This ensures that lenders are dealing with authorized representatives, adding another layer of security to the credit process.

The Business Plan is another document that can complement the Business Credit Application. While the credit application focuses on financial data, the business plan provides a broader view of the business's goals, strategies, and market analysis. Lenders may review the business plan to understand how the requested credit will support the business's growth and sustainability.

Finally, the Credit Report is a critical document that often accompanies the Business Credit Application. This report provides a detailed history of the business's credit activity, including outstanding debts and payment history. Lenders use the credit report to assess the risk associated with lending to the business, making it a vital component of the overall credit evaluation process.