Blank Broker Price Opinion Template

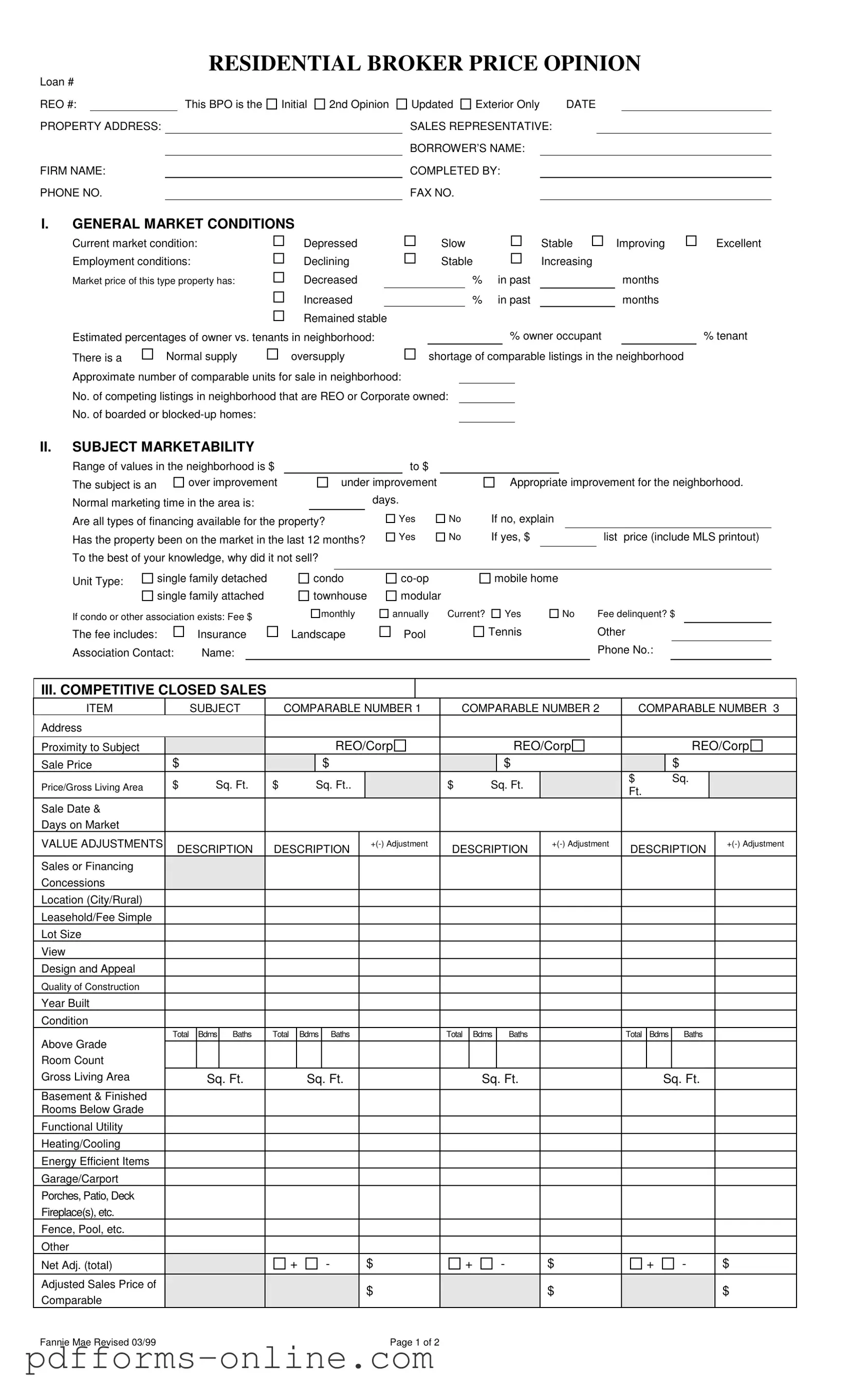

The Broker Price Opinion (BPO) form serves as a critical tool in the real estate industry, particularly for assessing the value of residential properties. This comprehensive document encompasses various sections that provide essential insights into the property’s marketability and value. It begins with general market conditions, where the evaluator notes the current state of the market—whether it is depressed, stable, or improving—and examines employment conditions and the supply of comparable listings in the neighborhood. The form requires the evaluator to analyze the subject property's marketability by estimating a range of values and identifying any over or under improvements. It also addresses the financing options available for the property and includes a history of the property’s market presence over the past year. Moreover, the BPO form incorporates a comparative analysis of closed sales, allowing the evaluator to adjust values based on various factors such as location, condition, and amenities. Finally, it offers insights into competitive listings, marketing strategies, and necessary repairs, culminating in a suggested market value. By synthesizing these elements, the BPO form provides a well-rounded perspective that aids lenders, investors, and real estate professionals in making informed decisions regarding property transactions.

Document Example

RESIDENTIAL BROKER PRICE OPINION

Loan #

REO #:This BPO is the

PROPERTY ADDRESS:

FIRM NAME:

PHONE NO.

Initial

2nd Opinion

Updated Exterior Only |

DATE |

|||

SALES REPRESENTATIVE: |

|

|

|

|

BORROWER’S NAME: |

|

|

|

|

COMPLETED BY: |

|

|

|

|

FAX NO. |

|

|

|

|

I.GENERAL MARKET CONDITIONS

Current market condition: |

Depressed |

Slow |

|

Stable |

Improving |

||

Employment conditions: |

Declining |

Stable |

|

Increasing |

|

||

Market price of this type property has: |

Decreased |

|

|

% |

in past |

|

months |

|

Increased |

|

|

% |

in past |

|

months |

|

Remained stable |

|

|

|

|

|

|

Estimated percentages of owner vs. tenants in neighborhood: |

|

|

% owner occupant |

|

|||

There is a |

Normal supply |

oversupply |

shortage of comparable listings in the neighborhood |

||||

Approximate number of comparable units for sale in neighborhood: |

|

|

|

|

|

||

No. of competing listings in neighborhood that are REO or Corporate owned:

No. of boarded or

Excellent

% tenant

II.SUBJECT MARKETABILITY

Range of values in the neighborhood is $ |

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

|

The subject is an |

over improvement |

|

|

under improvement |

|

Appropriate improvement for the neighborhood. |

||||||||

Normal marketing time in the area is: |

|

|

|

|

days. |

|

|

|

|

|

|

|||

Are all types of financing available for the property? |

Yes |

No |

If no, explain |

|

|

|

||||||||

Has the property been on the market in the last 12 months? |

Yes |

No |

If yes, $ |

|

|

list price (include MLS printout) |

||||||||

To the best of your knowledge, why did it not sell? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Unit Type: |

single family detached |

|

condo |

|

mobile home |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

single family attached |

|

townhouse |

modular |

|

|

|

|

|

|

||||

If condo or other association exists: Fee $

monthly

annually Current?

Yes

No |

Fee delinquent? $ |

The fee includes:

Association Contact:

Insurance

Name:

Landscape

Pool

Tennis |

Other |

|

Phone No.: |

III. COMPETITIVE CLOSED SALES

ITEM |

|

|

SUBJECT |

|

COMPARABLE NUMBER 1 |

|

COMPARABLE NUMBER 2 |

|

COMPARABLE NUMBER 3 |

|||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

||||||||

Sale Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|||

Price/Gross Living Area |

$ |

|

Sq. Ft. |

$ |

|

Sq. Ft.. |

|

|

$ |

|

|

Sq. Ft. |

|

|

$ |

|

|

|

Sq. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Ft. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale Date & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

DESCRIPTION |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Bdms |

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|

Total |

|

Bdms |

|

Baths |

|

|

Total |

Bdms |

Baths |

|

|

|

||||||

Above Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

Sq. Ft. |

|

|

Sq. Ft. |

|

|

|

|

|

|

Sq. Ft. |

|

|

|

|

|

Sq. Ft. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adj. (total) |

|

|

|

|

|

+ |

- |

|

|

$ |

|

+ |

- |

|

$ |

|

+ |

|

|

- |

|

$ |

|

|||||||||

Adjusted Sales Price of |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Revised 03/99 |

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REO# |

Loan # |

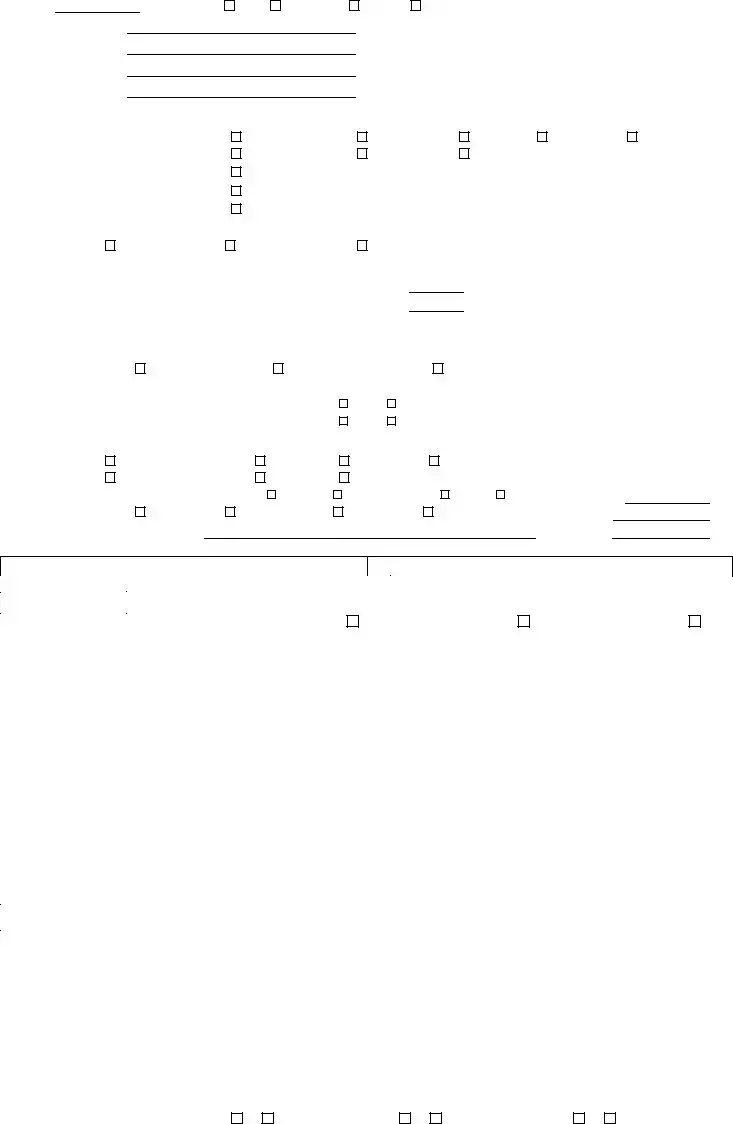

IV. MARKETING STRATEGY

Minimal Lender Required Repairs |

V. REPAIRS

Occupancy Status: Occupied

Repaired Most Likely Buyer:

Vacant

Unknown

Unknown

Owner occupant

Investor

Investor

Itemize ALL repairs needed to bring property from its present “as is” condition to average marketable condition for the neighborhood. Check those repairs you recommend that we perform for most successful marketing of the property.

$

$

$

$

$

$

$

$

$

$

|

|

|

|

GRAND TOTAL FOR ALL REPAIRS $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. COMPETITIVE LISTINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ITEM |

|

|

SUBJECT |

COMPARABLE NUMBER 1 |

COMPARABLE NUMBER. 2 |

COMPARABLE NUMBER. 3 |

|||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

|

|

REO/Corp |

||||||||||||

List Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

||

Price/Gross Living Area |

$ |

|

Sq.Ft. |

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

||||||||||

Data and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

DESCRIPTION |

|

+ |

DESCRIPTION |

|

DESCRIPTION |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

Total |

Bdms |

Baths |

Total |

Bdms |

Baths |

|

|

|

Total |

Bdms |

|

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Sq. Ft. |

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|||||||||||||

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net Adj. (total) |

|

|

|

|

+ |

- |

|

|

|

$ |

|

|

+ |

- |

- |

|

$ |

|

|

+ |

- |

|

$ |

|

|

||

Adjusted Sales Price |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

of Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

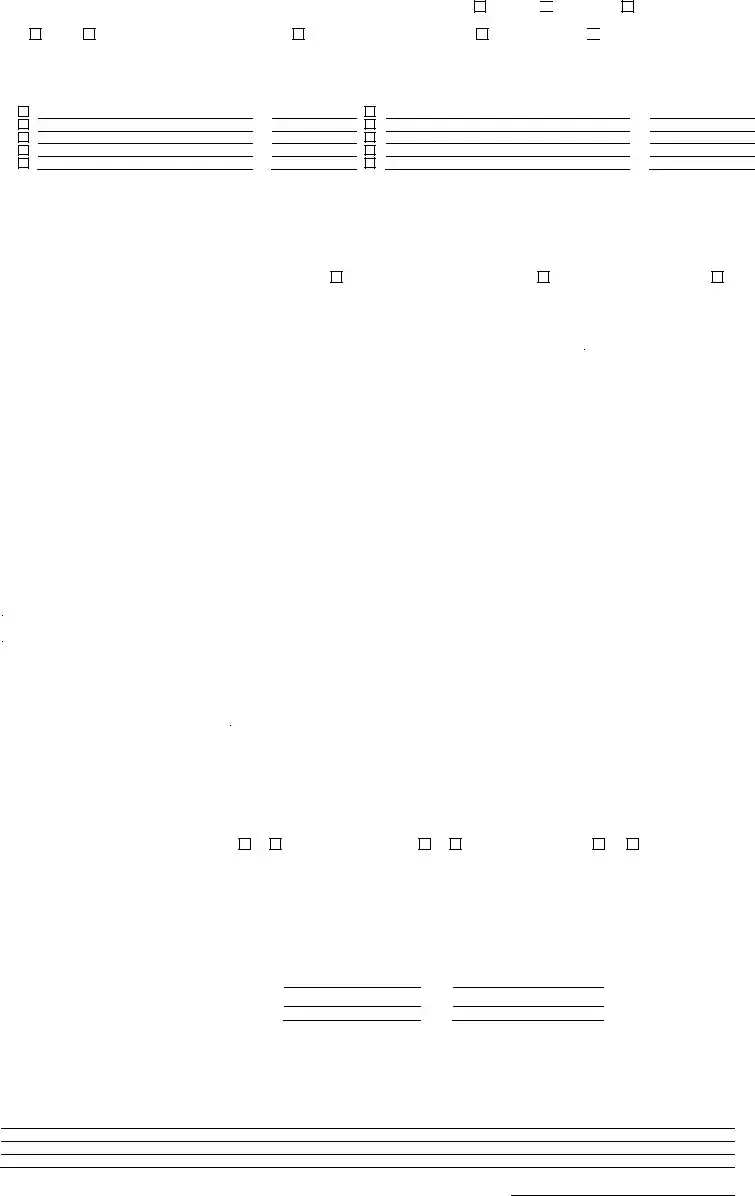

VI. THE MARKET VALUE (The value must fall within the indicated value of the Competitive Closed Sales).

Market Value |

Suggested List Price |

AS IS REPAIRED

30 Quick Sale Value

Last Sale of Subject, Price |

Date |

COMMENTS (Include specific positives/negatives, special concerns, encroachments, easements, water rights, environmental concerns, flood zones, etc. Attach addendum if additional space is needed.)

Signature: |

|

Date: |

Fannie Mae Revised 03/99 |

Page 2 of 2 |

CMS Publishing Company 1 800 |

Frequently Asked Questions

-

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is an estimate of the value of a property, usually conducted by a licensed real estate broker. It helps lenders and investors understand the market value of a property, particularly in situations involving foreclosures or short sales.

-

Why is a BPO important?

A BPO provides valuable insights into the current market conditions and helps determine a fair price for a property. It can influence decisions related to buying, selling, or financing a property. By analyzing comparable sales and market trends, a BPO aids in making informed financial decisions.

-

What information is included in a BPO?

A BPO typically includes details about the property being evaluated, such as its condition, location, and marketability. It also lists comparable properties, their sale prices, and adjustments made to account for differences. Additionally, the BPO will discuss market conditions and any necessary repairs to improve the property's value.

-

How is a BPO different from an appraisal?

While both a BPO and an appraisal aim to determine property value, they differ in scope and purpose. An appraisal is a more formal process conducted by a licensed appraiser and is often required for mortgage loans. A BPO is less formal, quicker to complete, and typically used for internal assessments by lenders or investors.

-

Who orders a BPO?

Typically, lenders, banks, or real estate investors order a BPO. They may need this information to assess the value of properties in their portfolios, especially when considering foreclosure or selling options. Real estate agents may also request a BPO to help clients set competitive listing prices.

-

How long does it take to complete a BPO?

The time required to complete a BPO can vary, but it usually takes a few days. Factors such as the complexity of the property, the availability of comparable sales data, and the workload of the broker can all influence the timeline.

-

What factors can affect the value determined in a BPO?

Several factors can influence the value in a BPO, including the property's condition, location, and recent sales of similar properties. Market trends, economic conditions, and the availability of financing options also play a significant role in determining the property's value.

Misconceptions

- Broker Price Opinions (BPOs) are the same as appraisals. While both BPOs and appraisals assess property value, BPOs are generally less formal and often used for quick evaluations, primarily by real estate agents.

- Only licensed appraisers can complete a BPO. In many states, real estate agents can perform BPOs as part of their duties, provided they follow local regulations.

- BPOs are always accurate. The accuracy of a BPO can depend on the agent’s knowledge of the market and the data available. They are estimates and should be treated as such.

- A BPO is a legal document. A BPO is not a legally binding document like an appraisal, but it can still influence financial decisions.

- All BPOs include the same information. The content of a BPO can vary significantly based on the property type, market conditions, and the specific requirements of the lender or client.

- BPOs can only be used for residential properties. While commonly associated with residential real estate, BPOs can also be conducted for commercial properties.

- A BPO can determine the final sale price. A BPO provides an estimate of value but does not set the final sale price, which is ultimately determined by negotiations between buyers and sellers.

- BPOs are always completed quickly. Although BPOs are generally faster than appraisals, the time taken can vary based on the complexity of the property and the market.

- BPOs are not influenced by current market trends. Current market conditions, such as supply and demand, play a significant role in determining the estimated value in a BPO.

- A BPO is only useful for lenders. While lenders often use BPOs, they can also be valuable for sellers, buyers, and investors to understand property value.

Common mistakes

-

Inaccurate Property Address: Failing to provide the correct property address can lead to confusion and miscommunication. This mistake can result in delays or incorrect evaluations.

-

Ignoring Market Conditions: Not accurately assessing the current market conditions can skew the valuation. It's essential to consider whether the market is depressed, stable, or improving.

-

Neglecting Comparable Listings: Omitting relevant comparable properties can lead to an incomplete analysis. Ensure that the number of comparable units and their conditions are thoroughly documented.

-

Overlooking Financing Options: Failing to check if all types of financing are available for the property can mislead potential buyers. If financing is limited, this should be clearly stated.

-

Incorrect Adjustment Calculations: Miscalculating adjustments for comparable sales can significantly affect the final valuation. Double-check all adjustments for accuracy.

-

Not Documenting Repairs: Failing to itemize necessary repairs can misrepresent the property's condition. A clear list helps set realistic expectations for potential buyers.

-

Inadequate Comments Section: Leaving the comments section blank or providing vague information can limit the understanding of the property's unique aspects. Specific details about positives and negatives are crucial.

-

Forgetting Signature and Date: Not signing and dating the form can render it invalid. Ensure all necessary signatures are obtained to confirm the report's authenticity.

Additional PDF Templates

Western Union Receipt Generator - Securely transfer funds to friends or family.

What Is a Construction Proposal - It encourages professional presentation of the contractor’s offerings.

A New York Lease Agreement form is a legal document that outlines the terms and conditions between a landlord and a tenant for renting a residential or commercial property. This form serves as a binding contract, detailing essential elements such as rental price, lease duration, and the responsibilities of both parties. To review a sample of this important document, you can visit documentonline.org/blank-new-york-lease-agreement/. Understanding this document is crucial for protecting rights and ensuring a smooth rental experience.

Affidavit of Support - It can help an immigrant apply for a green card.

Document Data

| Fact Name | Description |

|---|---|

| Purpose of BPO | A Broker Price Opinion (BPO) is used to estimate the value of a property, often for lenders or real estate agents to assist in pricing decisions. |

| Components of BPO | The BPO form includes sections on market conditions, subject property marketability, competitive closed sales, and marketing strategy. |

| Market Conditions | Market conditions are assessed as depressed, stable, or improving, helping to contextualize the property’s value in relation to current trends. |

| Financing Availability | The form inquires whether all types of financing are available for the property, which can significantly impact its marketability. |

| Repairs Assessment | It includes a section to itemize necessary repairs, which can affect the property's value and appeal to potential buyers. |

| State-Specific Forms | Some states have specific regulations governing BPOs, such as requiring licensed appraisers to perform them, ensuring compliance with local laws. |

Similar forms

The Comparative Market Analysis (CMA) is a document that real estate agents use to evaluate a property's value based on recent sales of similar properties in the area. Like the Broker Price Opinion (BPO), a CMA considers various factors such as location, property condition, and market trends. However, a CMA typically provides a more detailed analysis of comparable properties, including a broader range of data points and a deeper dive into market conditions. While both documents aim to estimate property value, a CMA is often more comprehensive, making it a valuable tool for agents and sellers alike.

The Appraisal Report serves a similar purpose to the Broker Price Opinion but is conducted by a licensed appraiser. An appraisal provides a professional assessment of a property's value based on a thorough inspection and analysis of the property and its surroundings. Unlike a BPO, which may rely more on market data and less on physical inspection, an appraisal includes a detailed examination of the property’s features, condition, and comparable sales. This makes the appraisal a more formal and legally recognized document, often required by lenders for financing purposes.

The Listing Agreement is another document that shares similarities with the Broker Price Opinion. While a BPO focuses on determining a property's value, a Listing Agreement outlines the terms under which a property will be marketed and sold. Both documents require an understanding of market conditions and property specifics. However, the Listing Agreement is more about the contractual relationship between the seller and the real estate agent, detailing commission rates, marketing strategies, and the duration of the listing.

In the realm of legal documentation, understanding the nuances of various agreements is crucial, particularly when it comes to protecting sensitive information. For instance, individuals and businesses seeking to maintain confidentiality often turn to a Non-disclosure Agreement form. By signing this document, parties can ensure that shared information is safeguarded against unauthorized access, emphasizing the importance of trust within any partnership or transaction. For more detailed resources on creating such agreements, you can refer to OnlineLawDocs.com.

The Purchase Agreement is closely related to the Broker Price Opinion in that it outlines the terms of a property sale. This document is used once a buyer has decided to purchase a property, often influenced by the BPO or appraisal value. The Purchase Agreement includes details such as the sale price, contingencies, and closing dates. While the BPO assesses value, the Purchase Agreement formalizes the transaction, making both documents essential in the buying and selling process.

The Seller’s Disclosure Statement is another document that complements the Broker Price Opinion. This statement provides potential buyers with important information about the property's condition and any known issues. While the BPO estimates value based on market conditions and comparable sales, the Seller’s Disclosure focuses on the property's physical attributes and any potential liabilities. Both documents play a crucial role in ensuring transparency during the sale process.

Lastly, the Property Condition Report is similar to the Broker Price Opinion in that it evaluates the physical state of a property. This report is often used by buyers and lenders to assess the condition of a home before purchase. While the BPO focuses on market value, the Property Condition Report highlights the structural integrity and necessary repairs. Both documents help inform the buyer's decision-making process, but they serve distinct purposes in the real estate transaction.