Blank Auto Insurance Card Template

When driving a vehicle, having the Auto Insurance Card form on hand is essential for every driver. This card serves as proof of insurance and includes key information that can be crucial in the event of an accident. The card features the insurance identification number, the company number, and the policy number, all of which help identify your coverage. Additionally, it lists the effective and expiration dates, ensuring that you know when your coverage is valid. Important details about your vehicle, such as its year, make, model, and vehicle identification number (VIN), are also included. The agency or company that issued the card is noted, providing a point of contact for any inquiries. It is important to keep this card in your vehicle at all times and present it upon request if you are involved in an accident. The card also includes a reminder to report any accidents to your insurance agent as soon as possible, along with a checklist of information to gather. Finally, the front of the card features an artificial watermark, which can be viewed by holding it at an angle, adding an extra layer of security to this important document.

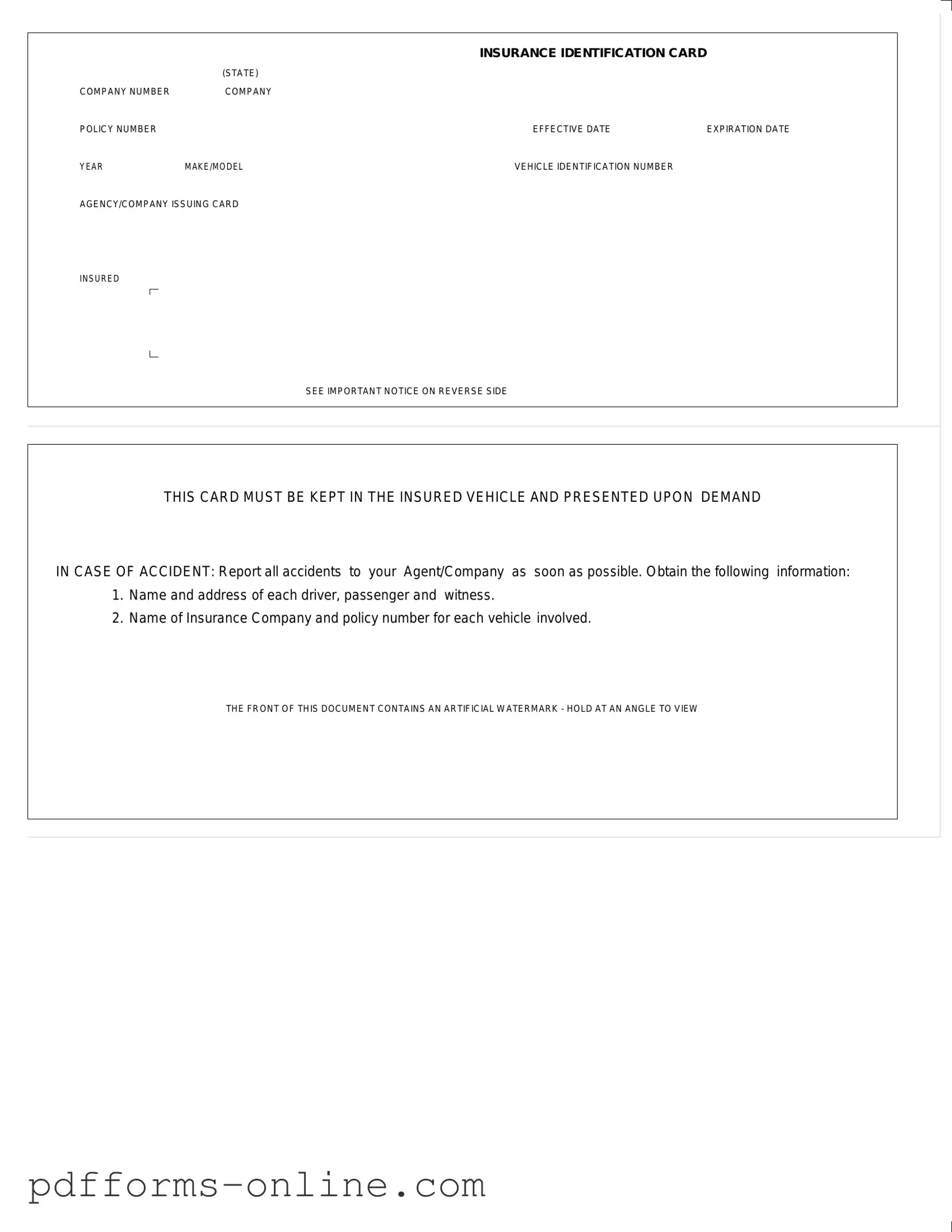

Document Example

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Frequently Asked Questions

-

What is an Auto Insurance Card?

An Auto Insurance Card is a document that proves you have insurance coverage for your vehicle. It includes important information such as your insurance company details, policy number, and vehicle information.

-

What information is included on the Auto Insurance Card?

The card typically contains the following details:

- Insurance identification card (state)

- Company number

- Company policy number

- Effective date

- Expiration date

- Year, make, and model of the vehicle

- Vehicle identification number (VIN)

- Agency or company issuing the card

-

Why do I need to keep the Auto Insurance Card in my vehicle?

It is essential to keep the Auto Insurance Card in your vehicle because you are required to present it upon demand in case of an accident. This card serves as proof of your insurance coverage and helps facilitate the claims process.

-

What should I do if I get into an accident?

If you are involved in an accident, report it to your agent or insurance company as soon as possible. Additionally, gather important information such as:

- Name and address of each driver, passenger, and witness

- Name of the insurance company and policy number for each vehicle involved

-

What does the "Important Notice" on the reverse side mean?

The "Important Notice" provides crucial information regarding your insurance coverage and the responsibilities you have in case of an accident. It is advisable to read this notice carefully to understand your rights and obligations.

-

How can I verify the authenticity of my Auto Insurance Card?

Your Auto Insurance Card contains an artificial watermark. To verify its authenticity, hold the card at an angle and look for the watermark. This feature helps prevent fraud and ensures that your card is legitimate.

-

What should I do if my Auto Insurance Card is lost or damaged?

If your Auto Insurance Card is lost or damaged, contact your insurance agent or company immediately. They can issue a replacement card for you, ensuring that you have the necessary proof of insurance while driving.

Misconceptions

Here are six common misconceptions about the Auto Insurance Card form:

- The card is optional and can be left at home. This is incorrect. The card must be kept in the insured vehicle at all times and presented upon demand in case of an accident.

- All information on the card is irrelevant. Not true. Each piece of information, such as the policy number and vehicle identification number, is crucial for verifying coverage and handling claims.

- The card does not need to be updated. This is a misconception. If there are changes to your policy or vehicle, you should ensure the card reflects the most current information.

- Only the primary driver needs to know about the card. This is misleading. All drivers of the insured vehicle should be aware of the card and its details, especially in case of an accident.

- The watermark on the card is just for decoration. This is false. The watermark serves as a security feature to prevent fraud and should be visible when viewed at an angle.

- Reporting an accident is optional if you have the card. This is incorrect. You must report all accidents to your agent or company as soon as possible, regardless of having the card.

Common mistakes

When filling out the Auto Insurance Card form, individuals often make critical mistakes. These errors can lead to complications when presenting the card or in the event of an accident. Here are six common mistakes:

- Incorrect Company Number: Failing to accurately enter the insurance company's number can cause delays in processing claims.

- Omitting Policy Number: Leaving the policy number blank or entering it incorrectly can create issues when verifying coverage.

- Wrong Effective or Expiration Dates: Miswriting these dates can result in confusion about the validity of the insurance coverage.

- Inaccurate Vehicle Identification Number (VIN): A mistake in the VIN can lead to complications in identifying the insured vehicle during an accident.

- Failure to Include Make/Model: Not specifying the year, make, or model of the vehicle can raise questions about the insurance policy's applicability.

- Neglecting to Keep the Card in the Vehicle: Forgetting to place the card in the insured vehicle can result in legal penalties during a traffic stop or accident.

Each of these mistakes can have serious repercussions. It is essential to double-check all entries on the form to ensure accuracy and compliance with state regulations.

Additional PDF Templates

Dd 214 - Access to benefits may require this form.

For those looking to navigate the intricacies of ownership transfer, an essential tool is the complete Tractor Bill of Sale document. This form is vital in ensuring that both parties are protected during the transaction, providing clear evidence of the sale and outlining critical information about the buyer and seller.

Broker Price Opinion Form - The BPO offers insight into the competitive landscape for similar properties.

Document Data

| Fact Name | Description |

|---|---|

| Insurance Identification Card Purpose | This card serves as proof of auto insurance coverage for the vehicle listed on the card. |

| Required Information | The card must include essential details such as the company number, policy number, effective date, and expiration date. |

| Vehicle Details | Information about the vehicle, including the make, model, and vehicle identification number (VIN), is required on the card. |

| Issuing Agency | The name of the agency or company that issues the card must be clearly stated. |

| Legal Requirement | In many states, it is mandatory to keep this card in the insured vehicle and present it upon request during an accident. |

| Accident Reporting | The card advises the insured to report all accidents to their insurance agent or company promptly and gather necessary information. |

Similar forms

The Vehicle Registration Document serves as proof that a vehicle is registered with the state. Similar to the Auto Insurance Card, it includes essential details such as the vehicle identification number (VIN), make and model, and the owner's name. This document must be kept in the vehicle at all times and is required during traffic stops or when involved in an accident. Both documents are crucial for legal compliance and ensuring that the vehicle is authorized for use on public roads.

The Title Certificate is another important document related to vehicle ownership. It indicates who legally owns the vehicle and includes details like the VIN and the owner's information. Like the Auto Insurance Card, the Title Certificate must be presented during the sale or transfer of the vehicle. Both documents help establish ownership and protect against fraud, ensuring that the rightful owner has the authority to operate or sell the vehicle.

The Bill of Sale is a document that records the transaction between a buyer and seller of a vehicle. It typically includes the sale price, vehicle details, and the names of both parties. While the Auto Insurance Card verifies coverage, the Bill of Sale confirms the transfer of ownership. Both documents are essential in the vehicle transaction process, providing legal protection for both parties involved.

The Emissions Certificate is required in many states to ensure that vehicles meet environmental standards. This document, like the Auto Insurance Card, must be kept with the vehicle and presented during inspections or when requested by law enforcement. Both documents serve to confirm compliance with state regulations, ensuring that the vehicle is safe and environmentally friendly for public use.

The Safety Inspection Certificate verifies that a vehicle meets specific safety standards. Similar to the Auto Insurance Card, it must be displayed in the vehicle and is often required during vehicle registration. Both documents play a vital role in ensuring that vehicles are safe for operation on public roads, protecting not only the driver but also other road users.

The auto insurance card and other related documents are vital for vehicle ownership and compliance with state laws. Alongside the insurance card, the California 3539 form is crucial for corporations and exempt organizations needing to request an automatic extension for filing their California tax returns. By understanding the importance of both the auto insurance card and the California 3539 form, individuals can better navigate their responsibilities as drivers and taxpayers, ensuring they are prepared for any situation on the road or in their financial dealings.

The Proof of Insurance Document is often required by law and serves as evidence that a vehicle is insured. This document contains similar information to the Auto Insurance Card, such as the insurance company's name, policy number, and effective dates. Both documents must be presented upon demand and are essential for compliance with state laws. They provide reassurance that the driver has the necessary coverage in case of an accident or other incidents.