Blank Articles of Incorporation Form

The Articles of Incorporation form serves as a foundational document for establishing a corporation in the United States. This important legal instrument outlines essential information about the corporation, including its name, purpose, and the address of its principal office. Additionally, it specifies the number of shares the corporation is authorized to issue and identifies the registered agent responsible for receiving legal documents on behalf of the corporation. The form may also include details about the corporation's duration, whether it is intended to exist indefinitely or for a specified period. Furthermore, it often requires the names and addresses of the initial directors, providing transparency about the individuals guiding the corporation's governance. By filing this document with the appropriate state authority, businesses can officially gain legal recognition, enabling them to operate within the legal framework established for corporations. Understanding the components and requirements of the Articles of Incorporation is crucial for entrepreneurs looking to navigate the complexities of business formation effectively.

Document Example

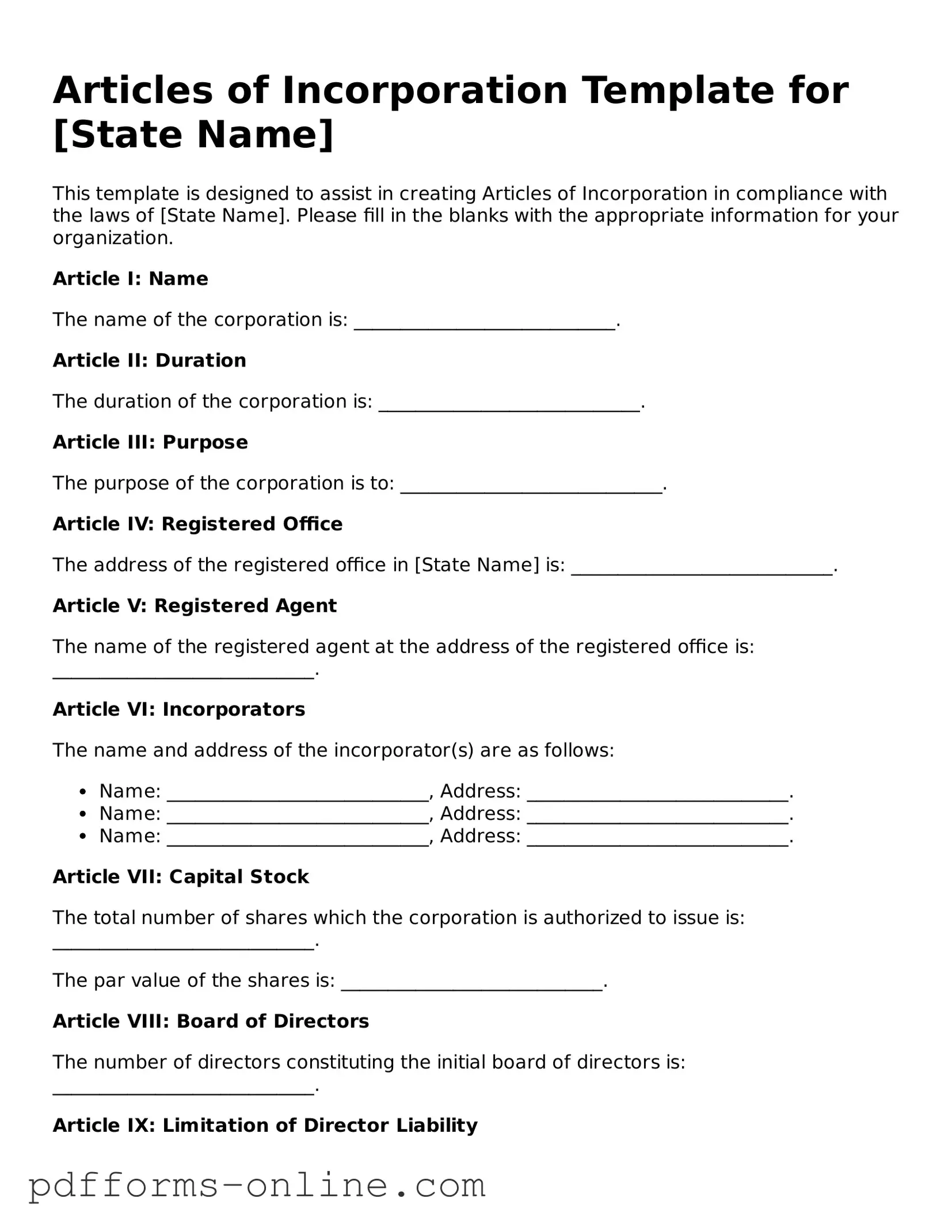

Articles of Incorporation Template for [State Name]

This template is designed to assist in creating Articles of Incorporation in compliance with the laws of [State Name]. Please fill in the blanks with the appropriate information for your organization.

Article I: Name

The name of the corporation is: ____________________________.

Article II: Duration

The duration of the corporation is: ____________________________.

Article III: Purpose

The purpose of the corporation is to: ____________________________.

Article IV: Registered Office

The address of the registered office in [State Name] is: ____________________________.

Article V: Registered Agent

The name of the registered agent at the address of the registered office is: ____________________________.

Article VI: Incorporators

The name and address of the incorporator(s) are as follows:

- Name: ____________________________, Address: ____________________________.

- Name: ____________________________, Address: ____________________________.

- Name: ____________________________, Address: ____________________________.

Article VII: Capital Stock

The total number of shares which the corporation is authorized to issue is: ____________________________.

The par value of the shares is: ____________________________.

Article VIII: Board of Directors

The number of directors constituting the initial board of directors is: ____________________________.

Article IX: Limitation of Director Liability

To the fullest extent permitted by [State Name] law, directors of the corporation shall not be liable to the corporation or its shareholders for monetary damages for any breach of fiduciary duty.

Article X: Indemnification

The corporation shall indemnify any officer, director, employee, or agent against expenses and liabilities incurred in connection with the corporation, as permitted by law.

Article XI: Miscellaneous

This corporation shall not engage in any activities contrary to the laws of [State Name].

IN WITNESS WHEREOF, the undersigned incorporator has executed these Articles of Incorporation on the ___ day of __________, 20__.

____________________________________

Signature of Incorporator

____________________________________

Printed Name

State-specific Guides for Articles of Incorporation Documents

Frequently Asked Questions

-

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the United States. They outline basic information about the company, such as its name, purpose, and the number of shares it can issue. This document is filed with the state government to officially create the corporation.

-

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is essential for several reasons. First, it provides legal recognition to your business, protecting your personal assets from business liabilities. Second, it allows you to conduct business under a corporate name and gain credibility with customers and suppliers. Lastly, it may be a requirement to obtain certain licenses and permits.

-

What information is typically required in the Articles of Incorporation?

The Articles of Incorporation usually require the following information:

- The name of the corporation

- The purpose of the corporation

- The registered agent’s name and address

- The number of shares the corporation is authorized to issue

- The names and addresses of the incorporators

Some states may require additional information, so it's important to check local regulations.

-

How do I file Articles of Incorporation?

To file Articles of Incorporation, you typically need to complete the form provided by your state’s business filing office. After filling it out, submit it along with any required fees. Many states allow online filing, which can be a quicker option. Once the state processes your application, you will receive a certificate confirming your corporation's formation.

Misconceptions

When it comes to the Articles of Incorporation, many people have misunderstandings about what this document entails and its purpose. Here are eight common misconceptions, along with clarifications to help you better understand this important form.

- Misconception 1: Articles of Incorporation are only necessary for large businesses.

- Misconception 2: Filing Articles of Incorporation guarantees business success.

- Misconception 3: The Articles of Incorporation are the same in every state.

- Misconception 4: You can file Articles of Incorporation at any time.

- Misconception 5: Once filed, Articles of Incorporation cannot be changed.

- Misconception 6: Articles of Incorporation are only needed for for-profit businesses.

- Misconception 7: The Articles of Incorporation are a lengthy and complicated document.

- Misconception 8: You don’t need legal help to file Articles of Incorporation.

This is not true. Any business that wishes to operate as a corporation, regardless of size, must file Articles of Incorporation. This includes small businesses and startups.

While this document is essential for establishing a corporation, it does not guarantee success. A solid business plan and effective management are crucial for achieving business goals.

Each state has its own requirements and forms for Articles of Incorporation. It is important to check the specific regulations in the state where you plan to incorporate.

While you can prepare the document at any time, it must be filed with the state before your corporation can officially exist. Timing can be crucial for business operations.

In fact, you can amend your Articles of Incorporation if necessary. Changes to the business structure or other details can be updated through a formal amendment process.

This is incorrect. Nonprofit organizations also need to file Articles of Incorporation to establish their legal status and gain certain tax exemptions.

While the form does require specific information, it is typically straightforward. Most states provide guidance on what information needs to be included.

Although many people file without legal assistance, consulting with a legal expert can help ensure that all requirements are met and that the document is completed correctly.

Common mistakes

-

Incorrect Business Name: Many people fail to check if their desired business name is available. It's essential to ensure that the name is unique and not already in use by another entity. A quick search through the state’s business registry can prevent future complications.

-

Missing Registered Agent Information: Every corporation must designate a registered agent. This person or business must have a physical address in the state of incorporation. Omitting this information can lead to delays in processing the application.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly defined. Some individuals provide vague or overly broad descriptions. A specific and concise purpose statement helps clarify the business’s intent and can avoid issues later on.

-

Failure to Include Necessary Signatures: Signatures from the incorporators are required. Sometimes, individuals forget to sign the form or assume that electronic submissions don’t need a signature. This oversight can result in the rejection of the application.

-

Not Reviewing State-Specific Requirements: Each state has its own regulations regarding Articles of Incorporation. Failing to familiarize oneself with these requirements can lead to incomplete forms. Always review the specific guidelines for the state where the corporation is being formed.

Popular Templates

Does California Have a Transfer on Death Deed - Beneficiaries are not responsible for the owner's debts unless they are specifically connected to the property transferred.

Child Guardianship Forms - This serves as an official request for temporary custody arrangements.

The Georgia Deed form is a crucial document used in real estate transactions within the state of Georgia. It legally transfers property ownership from the seller to the buyer, and for those seeking more information and resources related to this process, visiting https://onlinelawdocs.com/ can be invaluable. Understanding the details of this form is essential for anyone involved in buying or selling property in Georgia.

Better Business Bureau Reviews - Request resolution for a warranty issue.

PDF Attributes

| Fact Name | Description |

|---|---|

| Definition | The Articles of Incorporation is a legal document that establishes a corporation in the United States. |

| Purpose | This document outlines the basic information about the corporation, including its name, purpose, and structure. |

| State-Specific Forms | Each state has its own version of the Articles of Incorporation, governed by state laws. |

| Filing Requirement | To legally form a corporation, the Articles of Incorporation must be filed with the appropriate state agency. |

| Information Required | Typically, the form requires the corporation's name, registered agent, business purpose, and number of shares authorized. |

| Governing Law Example | In California, the governing law for Articles of Incorporation is found in the California Corporations Code. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record, accessible to anyone. |

| Amendments | Corporations can amend their Articles of Incorporation, but this requires filing additional paperwork with the state. |

| Fees | Filing fees for the Articles of Incorporation vary by state and can range from $50 to several hundred dollars. |

| Importance of Accuracy | Providing accurate information is crucial, as errors can lead to delays or rejection of the filing. |

Similar forms

The Articles of Incorporation form is similar to a business license application. Both documents serve as essential starting points for establishing a business. A business license application typically requires information about the business’s name, address, and type of operation, much like the Articles of Incorporation, which also demands details about the company’s name, purpose, and registered agent. While the Articles of Incorporation lay the groundwork for a corporation’s legal existence, the business license ensures that the business complies with local regulations and can operate legally within its jurisdiction.

Another document comparable to the Articles of Incorporation is the Operating Agreement, particularly for Limited Liability Companies (LLCs). While the Articles of Incorporation establish the corporation's existence, the Operating Agreement outlines the internal workings of an LLC. It details the management structure, member responsibilities, and profit distribution. Both documents are crucial for defining the organization’s structure and governance, but they serve different types of entities and focus on different aspects of business operations.

When drafting a lease, landlords and tenants should consider the importance of a legally binding agreement that includes all necessary terms. A comprehensive Lease Agreement helps prevent disputes and clarifies each party's expectations. For those looking for a template, the documentonline.org/blank-new-york-lease-agreement/ is a valuable resource to ensure compliance and clarity in New York rental transactions.

The Bylaws of a corporation also share similarities with the Articles of Incorporation. While the Articles of Incorporation provide basic information necessary for the corporation's formation, the Bylaws set forth the rules and procedures for how the corporation will operate. Bylaws typically include details about board meetings, voting procedures, and the roles of officers. Both documents are foundational, but the Articles focus on external registration, whereas Bylaws govern internal management.

Lastly, the Certificate of Good Standing can be likened to the Articles of Incorporation. This document serves as proof that a corporation has been properly formed and is compliant with state regulations. While the Articles of Incorporation are submitted to create the corporation, the Certificate of Good Standing is often requested later to verify that the corporation is in good standing with the state, meaning it has fulfilled its obligations, such as filing annual reports and paying necessary fees. Both documents confirm the legitimacy of a business entity but serve different purposes in the lifecycle of the corporation.