Blank Advance Beneficiary Notice of Non-coverage Template

The Advance Beneficiary Notice of Non-coverage, often referred to as the ABN, plays a crucial role in the landscape of Medicare services. This form serves as a communication tool between healthcare providers and patients, ensuring that individuals are informed about potential costs associated with their care. When a provider believes that a service or item may not be covered by Medicare, they must issue an ABN to the patient before delivering that service. This notice outlines the specific service in question, explains the reasons for the anticipated non-coverage, and provides the patient with options. Patients are encouraged to make informed decisions about their healthcare, understanding both their rights and responsibilities. By signing the ABN, patients acknowledge their awareness of the potential out-of-pocket expenses they may incur. This process not only fosters transparency but also empowers patients to take an active role in their healthcare decisions, ensuring they are not caught off guard by unexpected bills. As such, the ABN is a vital document in navigating the complexities of Medicare, highlighting the importance of clear communication in the patient-provider relationship.

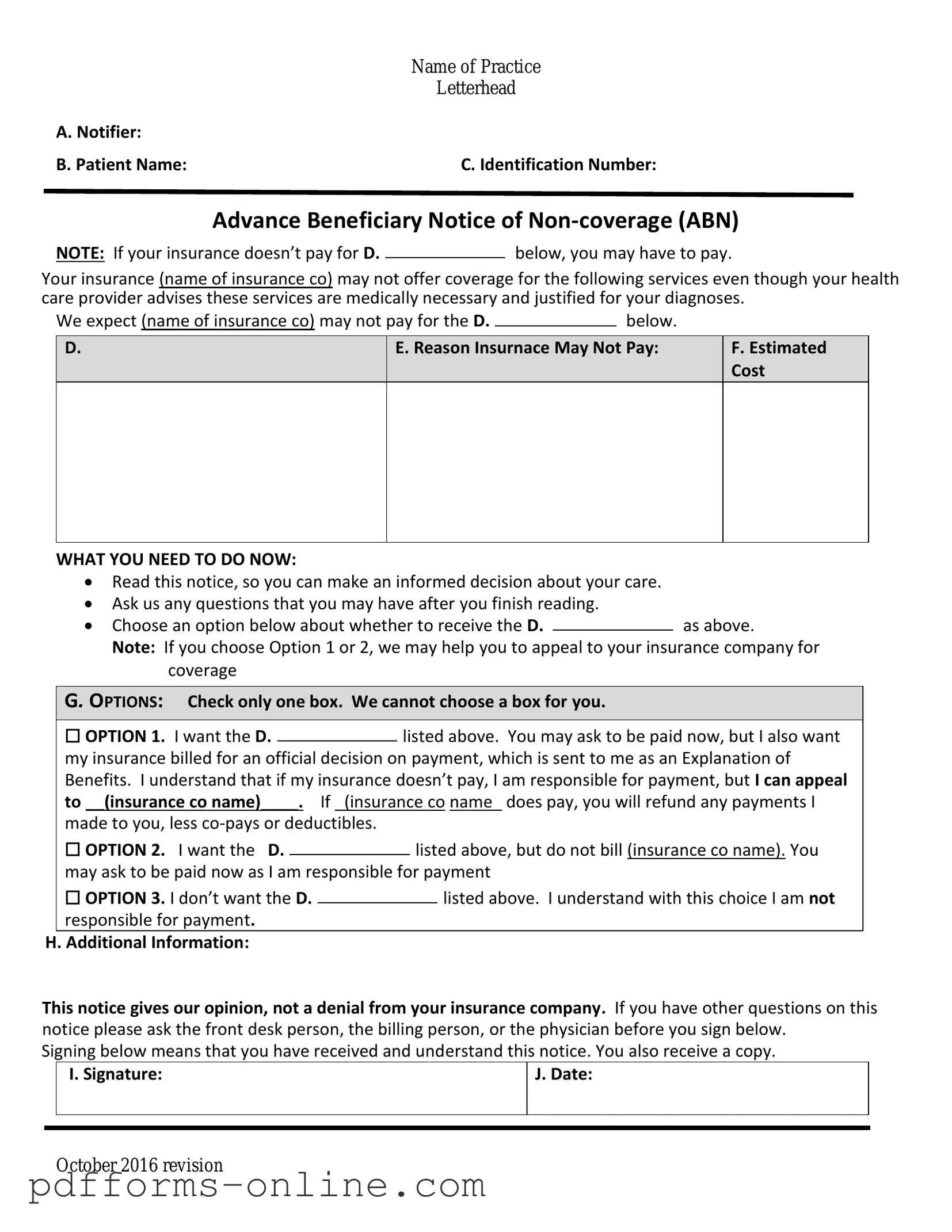

Document Example

|

Name of Practice |

|

Letterhead |

A. Notifier: |

|

B. Patient Name: |

C. Identification Number: |

Advance Beneficiary Notice of

NOTE: If your insurance doesn’t pay for D.below, you may have to pay.

Your insurance (name of insurance co) may not offer coverage for the following services even though your health care provider advises these services are medically necessary and justified for your diagnoses.

We expect (name of insurance co) may not pay for the D. |

|

below. |

|

D.

E. Reason Insurnace May Not Pay:

F.Estimated Cost

WHAT YOU NEED TO DO NOW:

Read this notice, so you can make an informed decision about your care.

Ask us any questions that you may have after you finish reading.

Choose an option below about whether to receive the D.as above.

Note: If you choose Option 1 or 2, we may help you to appeal to your insurance company for coverage

G. OPTIONS: Check only one box. We cannot choose a box for you.

|

☐ OPTION 1. I want the D. |

|

listed above. You may ask to be paid now, but I also want |

||||

|

|

||||||

|

my insurance billed for an official decision on payment, which is sent to me as an Explanation of |

||||||

|

Benefits. I understand that if my insurance doesn’t pay, I am responsible for payment, but I can appeal |

||||||

|

to __(insurance co name)____. If _(insurance co name_ does pay, you will refund any payments I |

||||||

|

made to you, less |

|

|

|

|||

|

☐ OPTION 2. I want the D. |

|

|

listed above, but do not bill (insurance co name). You |

|||

|

|

|

|||||

|

may ask to be paid now as I am responsible for payment |

||||||

|

☐ OPTION 3. I don’t want the D. |

|

|

|

listed above. I understand with this choice I am not |

||

|

|

|

|

||||

|

responsible for payment. |

|

|

|

|||

H. Additional Information: |

|

|

|

||||

This notice gives our opinion, not a denial from your insurance company. If you have other questions on this notice please ask the front desk person, the billing person, or the physician before you sign below.

Signing below means that you have received and understand this notice. You also receive a copy.

|

I. Signature: |

J. Date: |

|

|

|

|

|

|

October 2016 revision

Frequently Asked Questions

-

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

The Advance Beneficiary Notice of Non-coverage, commonly referred to as the ABN, is a document used in the Medicare program. It informs beneficiaries that Medicare may not cover a specific service or item. By providing this notice, healthcare providers ensure that patients are aware of potential out-of-pocket costs before receiving the service.

-

When should I receive an ABN?

You should receive an ABN when a healthcare provider believes that Medicare may not pay for a service or item. This typically occurs before the service is rendered. The provider must explain why they think Medicare might deny coverage and give you the opportunity to decide whether to proceed with the service, knowing you may have to pay for it yourself.

-

What should I do if I receive an ABN?

If you receive an ABN, take the time to read it carefully. It will outline the service in question, the reason for potential non-coverage, and your options. You can choose to accept the service, understanding that you may be responsible for the payment, or you can decline the service. If you choose to proceed, make sure to keep a copy of the ABN for your records.

-

What happens if I don’t receive an ABN and Medicare denies payment?

If you do not receive an ABN and Medicare denies coverage for a service, you may have grounds to appeal the decision. However, without the ABN, it may be more challenging to argue that you were informed about the potential for non-coverage. It is advisable to discuss your situation with your healthcare provider or seek assistance from a Medicare representative.

-

Can I appeal a Medicare denial after receiving an ABN?

Yes, you can appeal a Medicare denial even after receiving an ABN. If you believe that the service should have been covered, you can file an appeal. The ABN serves as a record that you were informed of the potential for non-coverage, but it does not eliminate your right to contest the denial. Be sure to follow the appeals process outlined by Medicare.

-

Is there a specific format for an ABN?

Yes, the ABN must follow a specific format set by the Centers for Medicare & Medicaid Services (CMS). It should include details such as the patient's information, the service in question, the reason for non-coverage, and the options available to the patient. Providers must use the official ABN form to ensure compliance with Medicare regulations.

Misconceptions

The Advance Beneficiary Notice of Non-coverage (ABN) form can be confusing for many people. Here are some common misconceptions about this important document:

- Misconception 1: The ABN means Medicare will not pay for the service.

- Misconception 2: You must sign the ABN.

- Misconception 3: The ABN is only for specific types of services.

- Misconception 4: An ABN guarantees payment for the service.

Many people believe that receiving an ABN automatically indicates that Medicare will deny coverage. In reality, the ABN is a notification that a specific service may not be covered, but it does not guarantee that Medicare will refuse payment. It simply informs you that the provider thinks Medicare might not cover the service based on certain conditions.

Some individuals think they are obligated to sign the ABN. However, signing the form is not mandatory. If you choose not to sign, the provider may still proceed with the service, but you may be responsible for payment if Medicare denies coverage.

People often assume that ABNs are only used for certain medical services. In fact, they can be issued for a wide range of services, including tests, procedures, and even equipment. The key factor is that the provider believes Medicare may not cover the service in question.

It’s a common belief that signing the ABN ensures that the service will be paid for, but that is not true. Signing the ABN indicates that you understand the potential for non-coverage, but it does not guarantee payment. Ultimately, it is up to Medicare to decide whether the service is covered.

Common mistakes

-

Not understanding the purpose of the form. Many individuals fill out the Advance Beneficiary Notice of Non-coverage (ABN) without grasping its significance. This form informs patients about services that Medicare may not cover.

-

Failing to read the instructions carefully. Instructions are provided for a reason. Skipping this step can lead to incomplete or incorrect information.

-

Leaving sections blank. All relevant sections must be filled out. Omitting information can delay processing or lead to misunderstandings.

-

Not providing a clear reason for non-coverage. It’s essential to specify why the service may not be covered. Vague explanations can create confusion.

-

Incorrectly identifying the service. Ensure that the service in question is accurately described. Misidentification can result in complications.

-

Ignoring the signature requirement. A signature is necessary to validate the form. Forgetting to sign can render the document ineffective.

-

Not keeping a copy of the completed form. Retaining a copy is crucial for your records. This helps in case of disputes or follow-up questions.

-

Failing to ask questions. If there is any uncertainty, it’s vital to seek clarification. Ignoring doubts can lead to costly mistakes.

Additional PDF Templates

Direction to Pay - Helps record the agreement between all parties involved.

For those seeking to understand the nuances of the transfer process, the essential details of the tractor ownership change are captured in the Florida Tractor Bill of Sale documentation. This form is invaluable for ensuring both parties are protected during the sale.

Yugioh Deck List Form - Judges will complete this section for any further infractions.

Document Data

| Fact Name | Details |

|---|---|

| Purpose | The Advance Beneficiary Notice of Non-coverage (ABN) informs patients that Medicare may not cover a specific service or item. |

| Who Issues It | Healthcare providers issue the ABN to patients before providing services that may not be covered by Medicare. |

| Patient Rights | Patients have the right to receive the ABN and make informed decisions about their care. |

| Signature Requirement | Patients must sign the ABN to acknowledge understanding of potential non-coverage. |

| State-Specific Forms | Some states may have additional requirements or specific forms related to the ABN. Check local regulations. |

| Governing Law | Medicare regulations govern the use of the ABN, specifically 42 CFR § 411.20. |

| Timing of Issuance | The ABN should be provided before the service is rendered to ensure patient awareness. |

| Implications of Non-Signing | If a patient does not sign the ABN, they may be responsible for payment if Medicare denies coverage. |

| Types of Services | The ABN is commonly used for services like diagnostic tests, therapies, and certain outpatient procedures. |

| Follow-Up | Providers must keep a copy of the signed ABN for their records and may need to submit it with claims. |

Similar forms

The Advance Beneficiary Notice of Non-coverage (ABN) is similar to the Medicare Summary Notice (MSN). Both documents inform beneficiaries about services that may not be covered by Medicare. The MSN provides a summary of healthcare services received, detailing what Medicare paid, what the patient owes, and any services that were denied. While the ABN is proactive, alerting patients before services are rendered, the MSN is reactive, summarizing after the fact. Both documents play a crucial role in ensuring that beneficiaries understand their financial responsibilities regarding healthcare services.

For those navigating the complexities of mobile home transactions, it's essential to have the right documents in place to ensure a smooth process. Just like understanding Medicare's offerings, having a well-prepared Mobile Home Bill of Sale is crucial for both buyers and sellers. This form acts as a legal record of the transaction and helps prevent any potential disputes in the future. To simplify the process, you can easily access all necessary documentation, including the Mobile Home Bill of Sale, at All Arizona Forms, ensuring that you have everything required for your purchase or sale.

Another document akin to the ABN is the Notice of Exclusion from Medicare Benefits (NEMB). This notice is issued when a service is not covered by Medicare, similar to the ABN. However, the NEMB is used specifically for patients who have already received the service. It provides details about why Medicare won't cover the cost, ensuring patients are aware of their financial obligations. Like the ABN, it aims to prevent surprises in billing, but it does so after the fact.

The Explanation of Benefits (EOB) is also comparable to the ABN. After a service is provided, the EOB outlines what was billed, what was covered, and what the patient must pay. Unlike the ABN, which is provided before services are rendered, the EOB serves as a post-service summary. Both documents are essential for transparency in billing and help patients understand their financial responsibilities regarding their healthcare.

The Pre-authorization Request is another document that shares similarities with the ABN. This form is used by healthcare providers to obtain approval from insurance companies before providing certain services. Like the ABN, it helps ensure that patients are informed about the likelihood of coverage. While the ABN warns patients about potential non-coverage before services are provided, the pre-authorization request seeks to confirm coverage beforehand, allowing patients to make informed decisions.

The Out-of-Pocket Maximum Notice is also relevant. This document informs patients about their maximum financial responsibility for covered services within a plan year. While the ABN alerts patients to specific services that may not be covered, the out-of-pocket maximum notice provides a broader view of potential costs. Both documents aim to promote understanding and awareness of healthcare expenses, helping patients navigate their financial obligations.

In addition, the Provider-Patient Agreement can be compared to the ABN. This agreement outlines the terms of service between a healthcare provider and a patient, including payment responsibilities. Similar to the ABN, it ensures that patients are aware of their financial obligations before receiving care. The key difference lies in the scope; the Provider-Patient Agreement may cover a range of services, while the ABN focuses on specific non-covered services.

The Notice of Privacy Practices (NPP) is another document that, while different in purpose, shares a common goal with the ABN: patient awareness. The NPP informs patients about how their health information may be used and shared. While the ABN addresses potential costs, the NPP ensures that patients understand their rights regarding their personal health information. Both documents empower patients to make informed decisions about their healthcare.

Lastly, the Consent for Treatment form is similar in that it requires patient acknowledgment before services are provided. This document ensures that patients understand the nature of the treatment and any associated risks. Like the ABN, it serves to protect patients by ensuring they are informed before proceeding. Both documents emphasize the importance of patient understanding and consent in the healthcare process.