Blank Adp Pay Stub Template

The ADP Pay Stub form is an essential document for both employees and employers, serving as a detailed record of earnings and deductions for each pay period. This form provides a transparent breakdown of gross pay, taxes withheld, and various deductions, including health insurance and retirement contributions. Employees can easily track their earnings over time, ensuring they understand how their compensation is calculated. Additionally, the pay stub often includes vital information such as year-to-date earnings, which helps employees manage their finances and prepare for tax season. For employers, providing accurate pay stubs fosters trust and accountability in the workplace. Understanding the components of the ADP Pay Stub form is crucial for anyone who wants to navigate their financial landscape effectively.

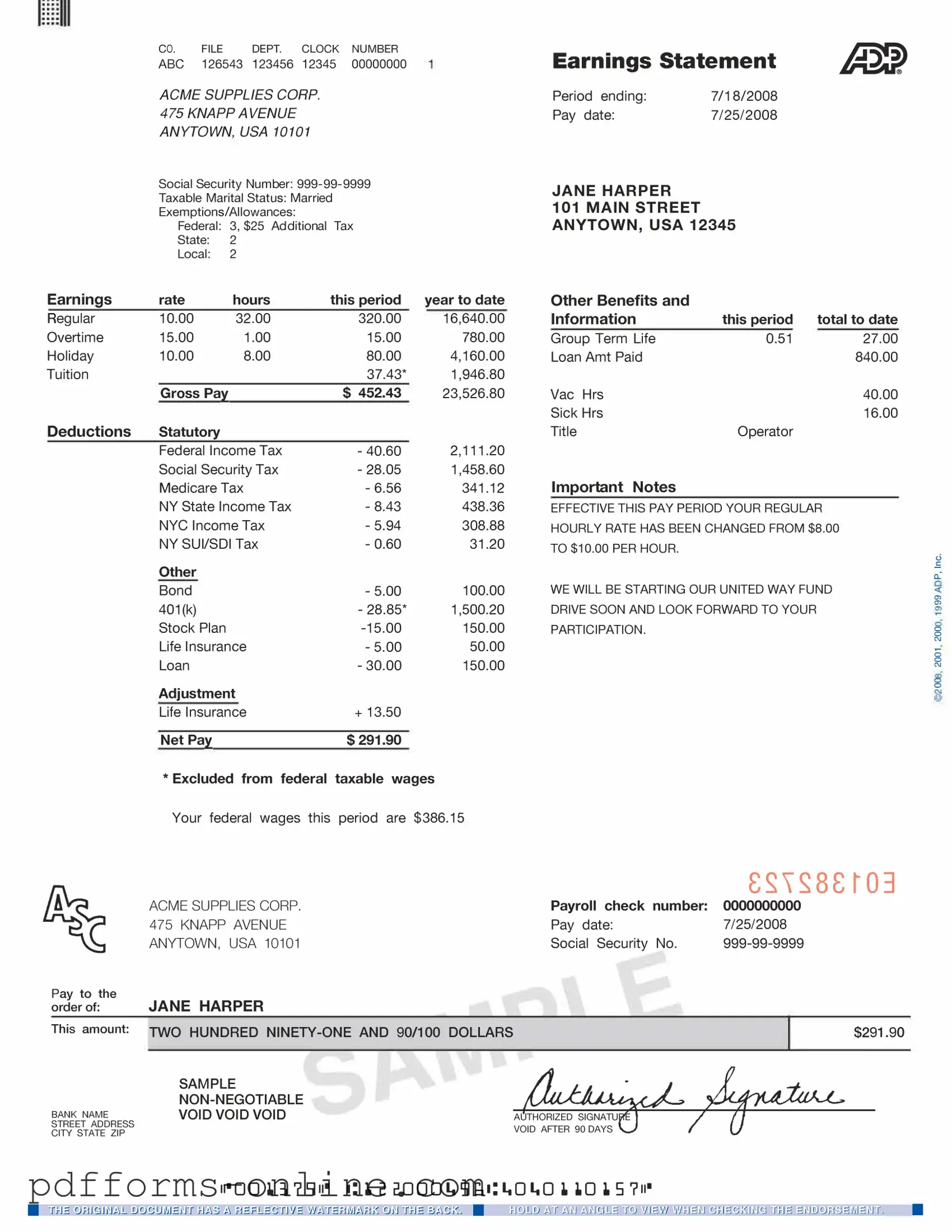

Document Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Frequently Asked Questions

-

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that details an employee's earnings for a specific pay period. It includes information such as gross pay, deductions, and net pay. This document serves as a record of compensation and can be used for personal finance management, tax purposes, and loan applications.

-

How can I access my ADP Pay Stub?

Employees can access their ADP Pay Stubs online through the ADP portal. You will need to log in using your credentials. If you are a first-time user, you may need to register for an account. Once logged in, navigate to the 'Pay' section to view and download your pay stubs.

-

What information is included on an ADP Pay Stub?

An ADP Pay Stub typically includes the following information:

- Employee name and identification number

- Pay period dates

- Gross earnings

- Deductions (such as taxes, retirement contributions, and health insurance premiums)

- Net pay (the amount you take home)

- Year-to-date earnings and deductions

-

What should I do if I notice an error on my pay stub?

If you find an error on your pay stub, it is important to address it promptly. First, double-check the figures to confirm the mistake. Then, contact your employer's payroll department for clarification. They can assist you in correcting any inaccuracies and ensuring that your records are updated.

-

Can I receive my ADP Pay Stub by mail?

Many employers offer electronic pay stubs through the ADP portal. However, some may still provide paper pay stubs by mail. If you prefer to receive your pay stub via mail, it is best to check with your employer's HR or payroll department to see if this option is available.

-

How long should I keep my ADP Pay Stubs?

It is advisable to keep your pay stubs for at least one year. This timeframe allows you to track your earnings, deductions, and tax information effectively. For tax purposes, retaining them for several years can be beneficial in case of audits or discrepancies.

-

What if I lose my ADP Pay Stub?

If you lose your pay stub, you can easily retrieve it through the ADP portal. Simply log in to your account and download the necessary pay stub. If you are unable to access the portal, contact your employer's payroll department for assistance in obtaining a duplicate.

-

Is my ADP Pay Stub secure?

Yes, ADP takes security seriously. The online portal uses encryption and other security measures to protect your personal information. However, it is always wise to take precautions by using strong passwords and logging out after each session.

Misconceptions

When it comes to understanding your ADP pay stub, misconceptions can lead to confusion. Here are six common myths about the ADP pay stub form, along with clarifications to help you navigate your pay information more effectively.

- Myth 1: The pay stub only shows my gross earnings.

- Myth 2: Deductions are always the same every pay period.

- Myth 3: My pay stub is the same as my W-2 form.

- Myth 4: I don’t need to keep my pay stubs.

- Myth 5: All deductions are for taxes.

- Myth 6: The pay stub is difficult to read and understand.

Many people believe that their pay stub only reflects gross earnings. In reality, it provides a comprehensive breakdown, including gross pay, deductions, and net pay. This detailed view helps you understand where your money is going.

Some assume that deductions remain constant. However, they can vary based on factors like overtime, bonuses, or changes in benefits. Always review your pay stub to see how deductions may fluctuate.

This is a common misunderstanding. While both documents provide information about your earnings, the pay stub is a summary of your earnings for a specific pay period, while the W-2 summarizes your earnings for the entire year.

Some people think that pay stubs are not worth saving. In fact, keeping them is important for tracking your earnings, verifying your income, and preparing for tax season. They can also be useful for loan applications or disputes.

Many believe that all deductions on their pay stub are tax-related. While taxes are a significant part, deductions can also include health insurance premiums, retirement contributions, and other benefits. Understanding these can help you manage your finances better.

People often think that pay stubs are too complex. However, with a little guidance, you can easily learn to interpret the various sections. Familiarizing yourself with the layout and terminology can make reading your pay stub a straightforward process.

By dispelling these misconceptions, you can gain a clearer understanding of your ADP pay stub and take control of your financial well-being.

Common mistakes

-

Incorrect Personal Information: Many individuals fail to provide accurate personal details such as their name, address, or Social Security number. This can lead to complications in tax reporting and benefits.

-

Wrong Pay Period Dates: Some people mistakenly enter the wrong start and end dates for the pay period. This can cause discrepancies in the calculation of hours worked and wages earned.

-

Misreporting Hours Worked: It is common for employees to miscalculate or misreport their total hours worked. This can result in underpayment or overpayment issues.

-

Ignoring Deductions: Many individuals overlook the importance of accurately reporting deductions. This includes taxes, retirement contributions, and health insurance premiums.

-

Failure to Update Changes: Some people do not update their information when they experience life changes, such as marriage or a new job. This can affect tax withholdings and benefits.

-

Not Double-Checking Entries: Rushing through the form can lead to simple errors. Always double-check your entries to ensure everything is correct.

-

Missing Signatures: Some individuals forget to sign the pay stub form. A missing signature can delay processing and cause issues with payroll.

-

Neglecting to Keep Copies: Failing to keep a copy of the submitted pay stub form can create problems later. Always retain a record for your own reference.

-

Ignoring Employer Instructions: Each employer may have specific instructions for filling out the form. Ignoring these can lead to errors and delays in processing.

Additional PDF Templates

Prehospital Medical Care Directive - Consider this directive as a guide that serves your best interests in various health situations.

Shared Well Agreement Example - This agreement addresses the shared use of a well system for two properties, ensuring access to water resources.

Document Data

| Fact Name | Description |

|---|---|

| What is an ADP Pay Stub? | An ADP Pay Stub is a document provided to employees that outlines their earnings, deductions, and net pay for a specific pay period. |

| Components of a Pay Stub | The pay stub typically includes the employee's gross pay, deductions for taxes and benefits, and the final net pay amount. |

| Frequency of Issuance | Employees usually receive pay stubs on a regular basis, such as weekly, bi-weekly, or monthly, depending on their employer's payroll schedule. |

| Importance of Record Keeping | Pay stubs serve as important records for employees to track their earnings and for tax purposes. |

| State-Specific Requirements | Some states have specific laws requiring employers to provide pay stubs, including California and New York. |

| Governing Laws in California | In California, employers must provide itemized wage statements as per the California Labor Code Section 226. |

| Governing Laws in New York | New York Labor Law Section 195 mandates that employers provide pay stubs to employees each pay period. |

| Electronic Pay Stubs | Many employers now offer electronic pay stubs, which can be accessed online. This option must comply with state laws regarding employee consent. |

| Understanding Deductions | Pay stubs break down deductions into categories like federal taxes, state taxes, Social Security, and health insurance, helping employees understand where their money goes. |

| Discrepancies and Corrections | If employees notice discrepancies on their pay stubs, they should promptly report them to their HR department for resolution. |

Similar forms

The W-2 form is a crucial document for employees in the United States. It summarizes an employee's annual earnings and the taxes withheld from their paychecks. Similar to the ADP Pay Stub, the W-2 provides a detailed account of income, but it covers a full year rather than a single pay period. Employees use the W-2 to file their income tax returns, making it essential for understanding overall tax obligations.

The pay statement from other payroll providers, such as Paychex or Gusto, shares many similarities with the ADP Pay Stub. These statements outline an employee's earnings for a specific pay period, including gross pay, deductions, and net pay. Like the ADP Pay Stub, they also often include year-to-date totals, helping employees track their earnings and deductions over time.

The 1099 form serves a different purpose but is similar in its detailed reporting of income. Independent contractors receive this form, which reports payments made to them throughout the year. While the ADP Pay Stub reflects wages for employees, the 1099 highlights earnings for non-employees, emphasizing the importance of accurate income reporting for tax purposes.

The direct deposit receipt offers a snapshot of an employee's earnings for a specific pay period, much like the ADP Pay Stub. It confirms that funds have been deposited into the employee's bank account. This document may not provide as much detail as a pay stub but serves the essential function of verifying payment and ensuring employees receive their wages on time.

The paycheck is a physical or electronic document that accompanies payment for work performed. It details the same components as the ADP Pay Stub, including gross pay, deductions, and net pay. While the ADP Pay Stub may serve as a summary, the paycheck is the actual payment instrument, making it a direct counterpart in the payroll process.

The payroll summary report provides an overview of payroll expenses for an organization. Similar to the ADP Pay Stub, it includes total wages, taxes withheld, and benefits costs. However, this report is geared toward employers, giving them a comprehensive view of payroll expenses rather than focusing on individual employee earnings.

The labor distribution report is another document that shares similarities with the ADP Pay Stub. It allocates employee labor costs across various departments or projects. While the pay stub details an individual’s earnings, the labor distribution report helps organizations understand where labor costs are incurred, allowing for better budget management.

The benefits statement outlines the benefits an employee receives, such as health insurance and retirement contributions. While the ADP Pay Stub may show deductions for these benefits, the benefits statement provides a clearer picture of what the employee is entitled to receive. Both documents are essential for understanding total compensation and benefits.

Lastly, the tax withholding statement provides details on the amount of taxes withheld from an employee's paycheck. This document is similar to the ADP Pay Stub in that it breaks down deductions but focuses specifically on tax obligations. It helps employees understand how much they owe in taxes and can inform their decisions regarding withholding allowances on their W-4 forms.