Blank Acord 50 WM Template

The Acord 50 WM form plays a crucial role in the insurance industry, particularly in the context of workers' compensation. This form serves as a comprehensive application for businesses seeking coverage, ensuring that employers can protect their employees against work-related injuries and illnesses. By detailing essential information about the business, including its operations, employee classifications, and payroll estimates, the Acord 50 WM form helps insurers assess risk accurately. Additionally, it facilitates the underwriting process, allowing for a more efficient determination of premiums and coverage options. Proper completion of this form is vital, as it not only impacts the coverage provided but also influences the overall safety and well-being of the workforce. Understanding the significance of the Acord 50 WM form is essential for business owners aiming to navigate the complexities of workers' compensation insurance effectively.

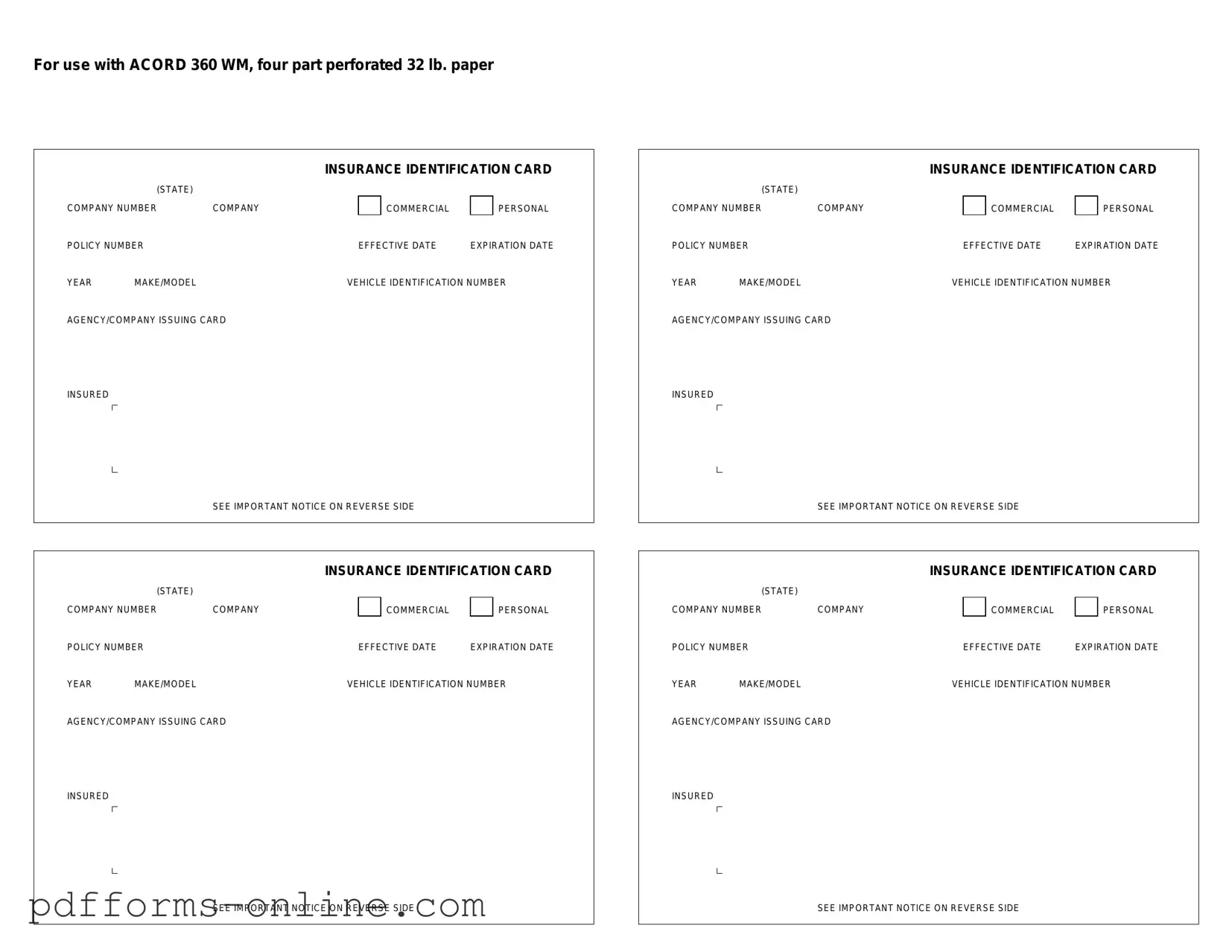

Document Example

For use with ACORD 360 WM, four part perforated 32 lb. paper

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

INSURANCE IDENTIFICATION CARD

|

(STATE) |

|

|

|

|

|

|

COMPANY NUMBER |

COMPANY |

|

|

COMMERCIAL |

|

PERSONAL |

|

POLICY NUMBER |

|

|

EFFECTIVE DATE |

EXPIRATION DATE |

|||

YEAR |

MAKE/MODEL |

|

VEHICLE IDENTIFICATION NUMBER |

||||

AGENCY/COMPANY ISSUING CARD |

|

|

|

|

|

||

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

THIS CARD MUST BE KEPT IN THE INSURED

VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

ACORD 50 WM (2007/03) |

© ACORD CORPORATION |

Frequently Asked Questions

-

What is the Acord 50 WM form?

The Acord 50 WM form, also known as the Acord Workers' Compensation Application, is a document used in the insurance industry. It serves as a standardized application for obtaining workers' compensation coverage. This form collects essential information about a business, including details about its operations, employee classifications, and payroll information. The data provided on this form helps insurance providers assess risk and determine appropriate coverage and premiums.

-

Who needs to fill out the Acord 50 WM form?

Any business that seeks workers' compensation insurance must complete the Acord 50 WM form. This includes companies of all sizes and industries. Whether a business has a few employees or hundreds, filling out this form is a crucial step in securing the necessary coverage to protect both the employer and employees in the event of work-related injuries or illnesses.

-

What information is required on the Acord 50 WM form?

The Acord 50 WM form requires various details about the business. Key sections include:

- Business Information: This section typically includes the business name, address, and contact information.

- Employee Information: Applicants must provide the number of employees, their job classifications, and the estimated payroll for each classification.

- Previous Coverage: Information about any prior workers' compensation insurance policies, including claims history, may also be requested.

Completing these sections accurately is vital for obtaining the correct coverage and premiums.

-

How is the Acord 50 WM form submitted?

The submission process for the Acord 50 WM form can vary depending on the insurance provider. Generally, businesses can submit the form electronically or via traditional mail. Many insurance companies offer online portals where applicants can fill out and submit the form directly. Alternatively, some may require a printed version to be mailed to their office. It is advisable to check with the specific insurance provider for their preferred submission method.

Misconceptions

The Acord 50 WM form is a key document in the insurance industry, specifically for workers' compensation. However, several misconceptions surround its use and purpose. Here are ten common misunderstandings:

-

The Acord 50 WM form is only for large businesses.

This form is applicable to businesses of all sizes. Small businesses also need to report their workers' compensation coverage.

-

The form is only needed once a year.

While it may be submitted annually, it should be updated whenever there are changes in coverage or business structure.

-

Completing the form is optional.

For many insurers, submitting the Acord 50 WM is a requirement to ensure compliance with state regulations.

-

The form is only for new policies.

It is also used for renewals and modifications to existing policies, not just for new ones.

-

Only the employer needs to fill it out.

Both the employer and the insurance agent may need to provide information to ensure accuracy.

-

The Acord 50 WM form is the same as the Acord 25 form.

These forms serve different purposes. The Acord 25 is for general liability, while the Acord 50 WM focuses on workers' compensation.

-

It does not require any supporting documents.

In some cases, additional documentation may be necessary to clarify the information provided.

-

Filling out the form is straightforward and error-free.

Many people find it complex, leading to potential mistakes. Double-checking is crucial.

-

Once submitted, the form cannot be changed.

Corrections can be made if errors are identified after submission. Contact your insurer for guidance.

-

The Acord 50 WM form guarantees coverage.

Filling out the form does not guarantee approval or coverage. Underwriting decisions are made separately.

Understanding these misconceptions can help ensure proper use of the Acord 50 WM form and compliance with insurance requirements.

Common mistakes

Filling out the Acord 50 WM form can be straightforward, but mistakes often occur. Here are seven common errors to avoid:

- Incomplete Information: Many people forget to fill out all required fields. Double-check that every section is complete to prevent delays.

- Incorrect Policy Numbers: Ensure that you enter the correct policy numbers. An error here can lead to confusion and processing issues.

- Missing Signatures: Not signing the form is a frequent oversight. Always sign and date the form before submission.

- Wrong Contact Information: Providing outdated or incorrect contact details can hinder communication. Verify that your information is current.

- Neglecting to Review: Skimming the form before submission can result in unnoticed errors. Take a moment to review everything carefully.

- Using Abbreviations: Avoid using abbreviations that may not be universally understood. Write out terms fully to ensure clarity.

- Not Following Instructions: Each form has specific instructions. Failing to follow them can lead to misunderstandings or rejections.

By being mindful of these common mistakes, you can help ensure a smoother process when submitting the Acord 50 WM form.

Additional PDF Templates

Fedex Reprint Commercial Invoice - Emergency contact details are required for shipments containing hazardous materials.

Completing the USCIS I-134 form can feel overwhelming, but resources are available to help navigate the process; for guidance, you can visit OnlineLawDocs.com, which provides valuable information about this important document and its requirements.

What Is a Construction Proposal - Contractors can detail payment terms and conditions clearly within the form.

Load Calculations - This document can help optimize energy usage over the lifespan of the system.

Document Data

| Fact Name | Details |

|---|---|

| Purpose | The Acord 50 WM form is used for workers' compensation insurance applications. |

| Common Usage | This form is commonly utilized by businesses seeking coverage for employee injuries. |

| State-Specific Forms | Some states require specific versions of the Acord 50 WM form to comply with local regulations. |

| Governing Laws | Each state has its own workers' compensation laws that govern the use of this form. |

| Submission Process | The completed form must be submitted to the insurance provider for processing. |

| Required Information | It typically requires details about the business, employee classifications, and payroll estimates. |

| Signature Requirement | A signature from an authorized representative of the business is necessary for validity. |

| Record Keeping | Businesses should retain a copy of the submitted form for their records. |

| Updates | The form may be updated periodically to reflect changes in regulations or practices. |

Similar forms

The Acord 50 WM form is a widely recognized document in the insurance industry, primarily used for workers' compensation insurance. Similar to the Acord 50 WM, the Acord 25 form serves as a standard application for general liability insurance. Both forms are designed to collect essential information about the insured party, including details about the business operations, ownership structure, and coverage needs. By providing a comprehensive overview of the applicant's risk profile, these forms help insurers assess potential liabilities and determine appropriate coverage options.

Another document that shares similarities with the Acord 50 WM is the Acord 130 form, which is used for commercial property insurance. Like the Acord 50 WM, the Acord 130 requires detailed information about the property being insured, including its location, usage, and any existing safety measures. Insurers rely on this information to evaluate the risk associated with insuring the property and to establish premium rates that reflect that risk accurately.

The Acord 27 form, which is utilized for commercial auto insurance, also parallels the Acord 50 WM in its purpose of risk assessment. This form gathers information about the vehicles to be insured, including their types, uses, and the driving records of the operators. By compiling this data, insurers can make informed decisions regarding coverage options and premium calculations, similar to the process used in workers' compensation assessments.

The Ohio Motor Vehicle Bill of Sale is a legal document that records the transfer of ownership for a vehicle in the state of Ohio. This form serves as proof of the transaction between the seller and buyer, detailing important information about the vehicle and the parties involved. Understanding its components and how to properly fill it out can streamline the vehicle transfer process significantly. For further details, you can visit https://documentonline.org/blank-ohio-motor-vehicle-bill-of-sale.

In the realm of health insurance, the Acord 48 form is another document that bears resemblance to the Acord 50 WM. The Acord 48 focuses on gathering information related to health care providers and their services. Like the Acord 50 WM, it requires specific details about the provider's operations, which assists insurers in evaluating risk and determining coverage needs for health-related liabilities.

The Acord 125 form, which is used for commercial general liability, shares common features with the Acord 50 WM. Both forms require information about the business operations and the types of risks associated with those operations. This information is crucial for insurers to understand the potential liabilities and to tailor coverage accordingly, ensuring that businesses are adequately protected against claims.

Similarly, the Acord 141 form, which pertains to professional liability insurance, also parallels the Acord 50 WM in its focus on risk assessment. The Acord 141 collects information about the professional services offered by the insured, as well as any previous claims history. This data is vital for insurers to evaluate the level of risk involved and to determine appropriate coverage limits and premiums.

The Acord 151 form, which is designed for excess liability insurance, shares similarities with the Acord 50 WM in that it requires detailed information about existing coverages and limits. Insurers use this information to assess the overall risk exposure of the insured and to determine whether additional coverage is necessary to protect against higher liability claims that may exceed standard policy limits.

The Acord 2 form, often used for personal auto insurance, also reflects the same principles found in the Acord 50 WM. This form collects information about the insured vehicle, the driver, and any previous claims. Insurers utilize this information to evaluate risk and set premiums, ensuring that drivers receive appropriate coverage based on their individual circumstances.

Additionally, the Acord 4 form, which is utilized for homeowners insurance, mirrors the Acord 50 WM in its emphasis on gathering information about the property and its occupants. Both forms aim to provide insurers with a comprehensive understanding of the risks involved, allowing for tailored coverage options that protect against potential claims.

Lastly, the Acord 45 form, used for life insurance applications, shares a common goal with the Acord 50 WM: assessing risk. While the Acord 45 focuses on the applicant's health and lifestyle factors, it similarly aims to provide insurers with the necessary information to determine coverage options and premiums. Both forms are integral in the risk evaluation process, ensuring that individuals receive appropriate insurance protection.